Everything this week hinges on the upcoming FOMC meeting

There will be a couple of light distractions in the run up to Wednesday's FOMC meeting but trading this week is going to revolve around the Fed, all things considered.

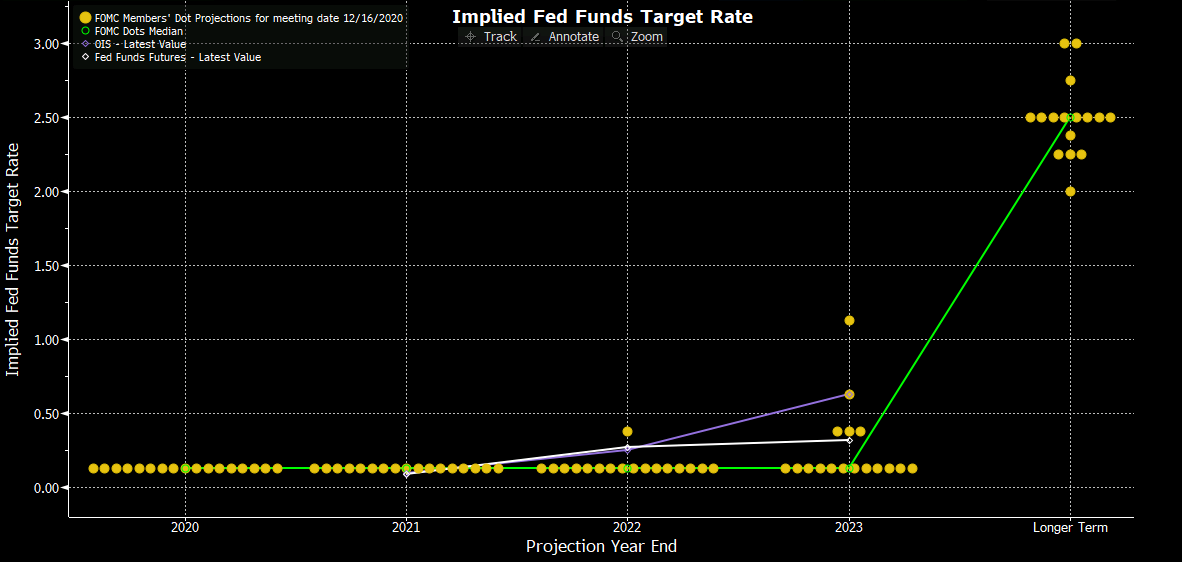

The language with regards to the bond market will be one to watch but the Fed will also be releasing its latest economic projections and dot plots are back in focus as well.

Imagine how would the market react if one rate hike was penciled in for 2023?

In case you need a reminder, here's how the previous (latest) projection from the Fed:

But as you can see, the market is well expecting a rate hike much earlier by the end of 2022 - with OIS pricing even indicating more than one hike by 2023.

Essentially, that's part and parcel of the story in what is contributing to the rise in yields too (it's not just an inflation story). So, will the Fed feel that its credibility is being undermined? Or is this all still acceptable for the time being? Or will they eventually cave?

That question is going to hold the key for Treasuries as yields are on the verge of an extended break higher as it holds at the February highs to start the week.