There are three ways to look at bitcoin right now, which is up $322 to $18,082 in the second day of gains:

1) CPI was soft, risk is on

Maybe it's as simple as that. Bitcoin rallied after soft CPI and is riding the 'risk on' train. There was a time when the bitcoin crowd pumped its resilience to inflation as a hedge but it's been exactly the opposite and lower CPI has been a catalyst.

2) Binance not imploding

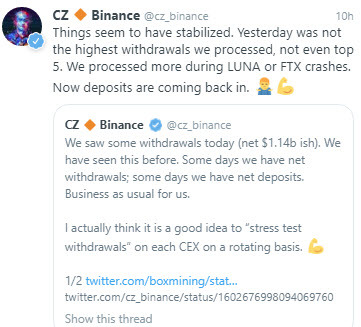

SBF is going to jail for a very long time but that's old news. Binance is connected to some 70% of bitcoin trading now and is the Goliath in the space. Plenty of people are screaming 'sell everything and close your account'. I certainly wouldn't argue with that sentiment but Binance hasn't cracked yet and every day that goes by without something blowing up is a good day in crypto. Changpeng Zhao is certainly expressing confidence, if that's worth anything.

3) Bitcoin as an exit ramp

This is the most-worrying scenario. Bitcoin often acts as a conduit in crypto due to its size and the ability to self-custody. Binance and many other brokers allow users to withdraw in bitcoin and this can be easier, faster and cheaper than withdrawing to a bank. The worry is that stablecoins are at risk. Yesterday, Binance paused withdrawals of the USDC stablecoin.

So what could be happening is that people are buying bitcoin as an off-ramp and the rally shows that liquidity is drying up. This could ultimately be a bullish scenario is crypto stabiliizes because we've now learned that anyone buying bitcoin in FTX was only buying numbers on a screen. Had all the money that was supposed to be flowing into bitcoin in 2021 actually ended up in it, the prices would have overshot the $67,000 high. There's often a similar lament in the precious metals market. Now whether that money and interest ever comes back to bitcoin is a different story but price tends to write narrative and today's price action is good.