Non trending transitions to trending.

A sideways range bound market is like a spring. Every time the range is tested, the coil notches tighter. When the range gives way, the spring uncoils in a powerful, trend-like move.

Breakout trading represents some of the fastest money in the forex market. Once you have identified a range bound market, with a narrow trading range, breakout trading involves watching it bounce back and forth and waiting for the extension either higher or lower.

It is thought that markets spend about a third of the time moving sideways. In this type of forex market, breakout trading is pretty straightforward, but can be profitable, fairly quickly.

What are the price action setup clues for a sideways breakout?

- A well-defined sideways range. The longer the consolidation, the more potential for an explosive move,

- A narrow(ish) low to high trading range, and

- A number of tests of the high and low extremes.

A typical minimum target on a break is the width of the range, but traders can often anticipate even more. The reason is that the smart and largest traders are often anxious for a big move after a consolidation period. Those traders have the muscle to trend the market. So if there is a time to be greedy, this is it.

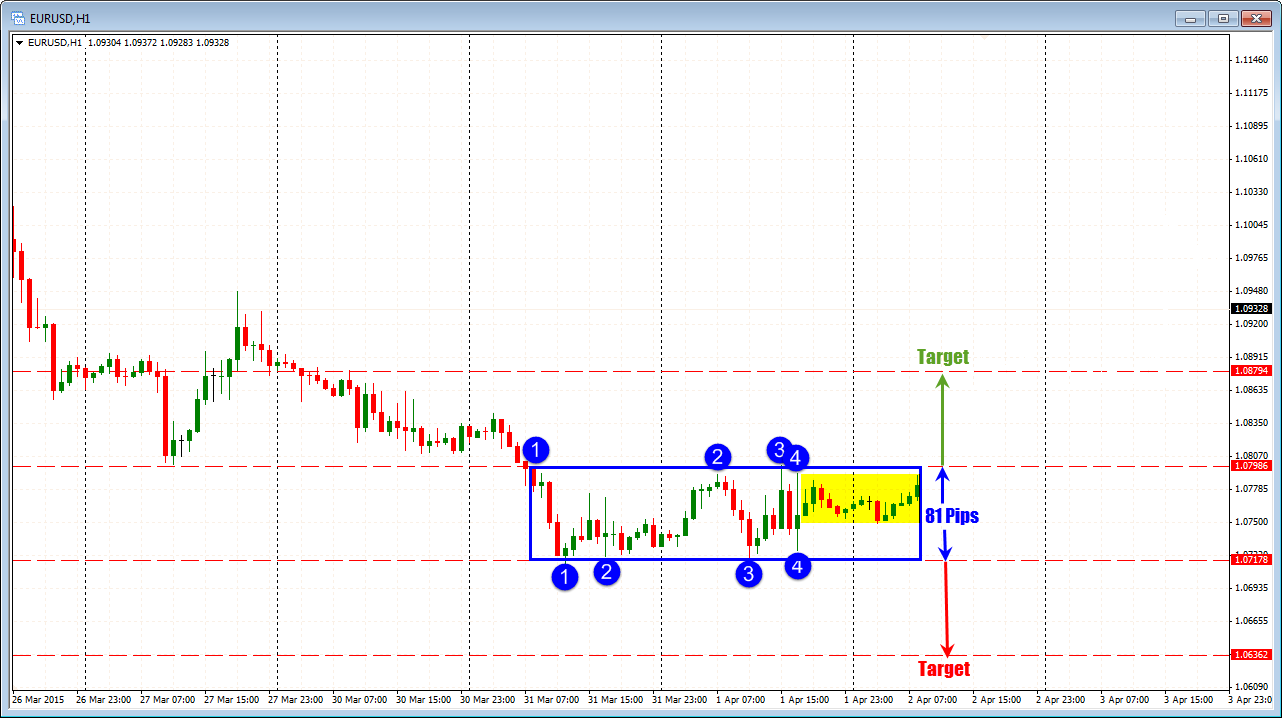

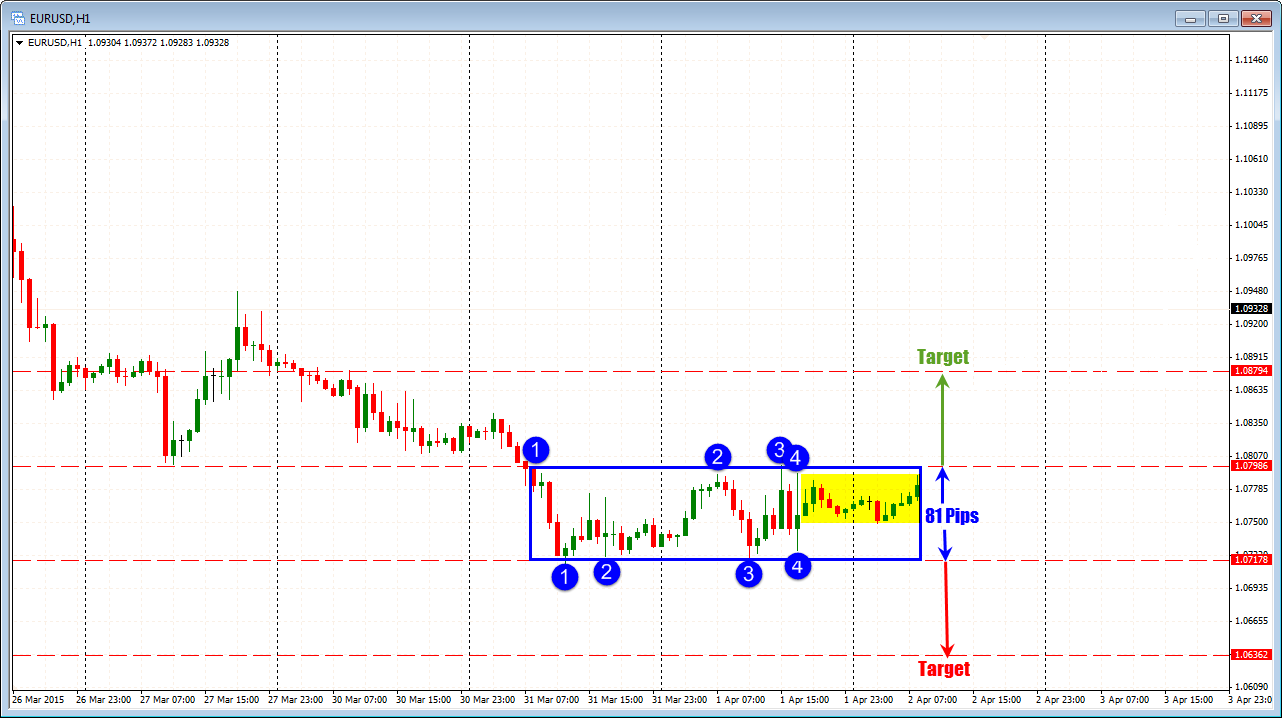

Example: EURUSD - Hourly chart

The EURUSD was trading in a sideways trading range over March 31 and April 1. The range was around 81 pips, which is low for a trading day, let alone a two-day period. Looking at the chart, the price tested the highs and lows on a number of hourly bars.. Over the last 15 hours of trading the range was only 38 pips (yellow area). During this sideways consolidation, the market was undecided on the directional bias, but it was likely to go somewhere. On a break the target would be the range (around 81 pips)

Do you need have to have a bullish or bearish bias?

No. Trading should be totally neutral. It does not matter if it goes higher or lower, just somewhere away from the current area.

What is the risk on the trade?

On a break, I want to see momentum fairly quickly. If the price moves 5 pips above and heads back into the range, I will look to risk no more than 10-12 pips below the break level. The purpose of the sideways breakout is to move away from the consolidation area. Not break a sideways range and re-enter.

It is time to look for the breakout.

What happened?

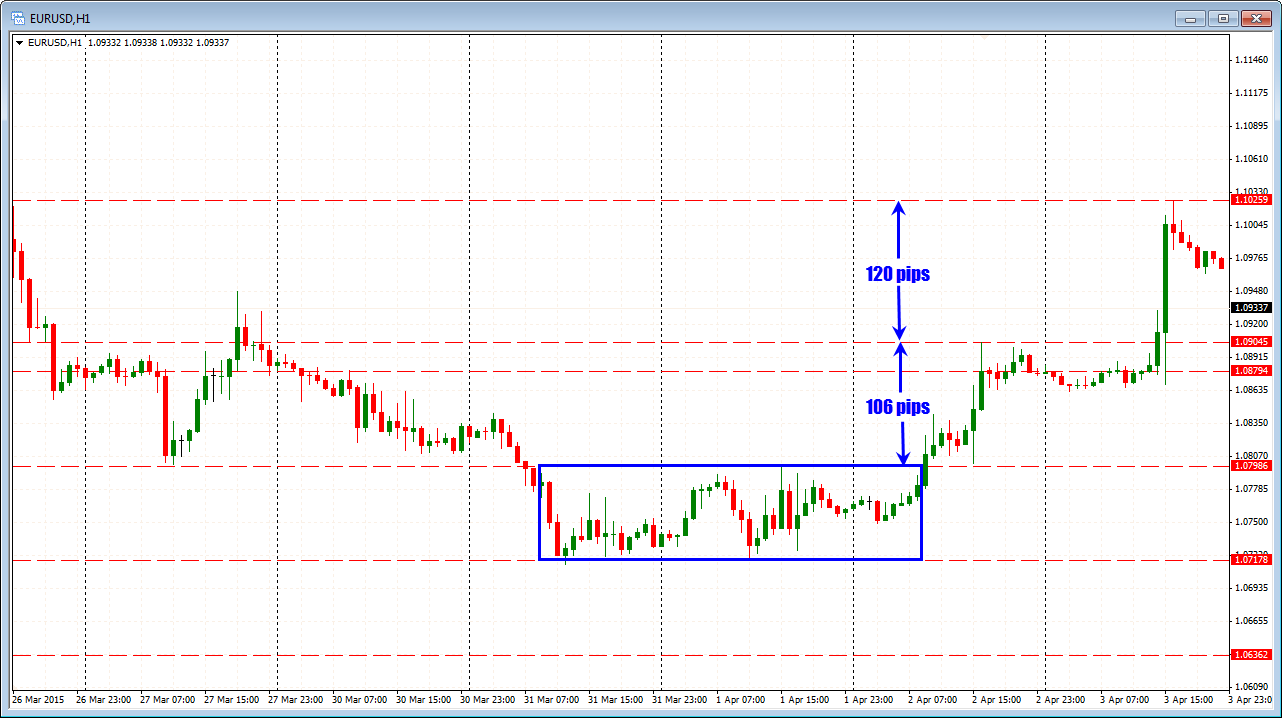

The price ended up breaking to the upside. After 8 hours, the price had extended up 106 pips. Not a bad gain (see chart below), given the risk.

Admittedly, the next day was the US employment day. I typically do not suggest taking a position through the employment number as it can be random gamble, but a trader who has 106 pips in a trade, might look to take partial profit and risk the profit on the residual position for additional trend gains. (put a stop at entry).

The employment report came out weaker than expectations and the price surged higher. The resulting gain would have netted the potential for an additional 120 pips of profit.

The total potential maximum profit for the two days was 226 pips. The risk was 10-15 pips.

MITIGATING THE FALSE BREAKOUT RISKS:

Breakout trading is a forex strategy that offers fast money but is fraught with perils. The false breakout is a heartbreaking development and a classic trading conundrum.

Of course losses are part of trading, and if I can "lose a little" (i.e., 10-15 pips), but make "more than a little" (with "more than a little" being a multiple of the risk), I should still be quite happy on the trades that do trend. Remember, a sideways breakout trade is not designed to make 10-15 pips, but a multiple of the risk.

I also recommend not being too quick in calling a market non trending. Try to let as much time go by as you can. Some traders will solely look for non--trending periods of at least 2 trading days before considering the trade. The longer the non-trending time period, and the more up and down tests of the extremes, the better chance that the break, will not be a false breakout. .

In the example, the market stayed in an 81 pip range for 50 hours. Moreover, the final 15-hour period where the pair traded in a 38 pip range was a clue that a breakout was coming. Why? Having a 38 pip trading range was simply too narrow a range for a 24-hour period. The chances at that point were that if there was a breakout to the upside, it would start a move away from the consolidation area. It was time to move on.

The Buyers Remorse Trade

Another final way to minimize the pain of a false breakout is by trading with a phenomenon called "Buyer's Remorse". Oftentimes, after the strong initial range break, the market will correct back to the limit of the range, before making an extended move higher. Some traders never buy on the initial breakout, but instead wait to pounce on the buyer's remorse dip.

In the example, the dip back down toward the 1.0798 level was the perfect low risk trading opportunity to buy (put a stop 10-15 pips into the consolidation box). After that level held, the market moved over 100 pips in 2 hours.

The smart money was waiting to get in on the trade on the dip, and they did it with gusto.