Your entry is not king. Nor is your exit

Your entry is not king. Nor is your exit.

In the realm of forex trading it is what is in front of you that is the ruler of your domain.

Unless you're George Soros you don't have the power to move the markets on your own, so your only choice is to flow with it, otherwise you are fighting a battle you just won't win.

But how many of you have a plan that lets you place trades based on what the market is truly doing? Or are you simply trading on a combination of indicators or a piece of advice and just hoping?

Here are three things you can do to assist you in trading what's in front of you.

Don't trade unless you know what's going on

Are you trading to scratch an itch?

Instead of placing trades for the sake of it, try and figure out what is going on. This generally will start with a big picture view. Develop a global macro perspective on the market and take a top down approach to your positions. This applies to you even if you are a short-term trader (yep, the big picture is influencing events all the way down to that 15 minute chart you are staring at).

You also want to look at the longer-term chart time-frames. Understand weekly support and resistance levels, and the longer-term trend (or lack thereof). Then look at global micro: what news events are going on that could impact the currency pair you are watching?

Once you have developed this understanding, you will start to get a feeling that a trade is either right on wrong before you place it. Hope is replaced with knowledge.

Use multiple exit strategies

After you get into the trade it really, really, really is not enough to have only one or even two reasons to exit.

If you are determined to always go for that juicy level as your profit target, and no matter what the market does you are going to hold on until it gets there, then you are not a discretionary trader. You might as well get a robot to do the work for you (they will do it with less mistakes).

The advantage of being a discretionary trader is that you can look at the market after the trade is placed and respond accordingly in alignment with your objectives for the position, and what the market is doing.

This means that you are going to want to have multiple exit strategies in your repertoire to pull out as and when you need them. You might have:

Initial target

Trailing stop for a slow moving market

Trailing stop for a normally moving market

Trailing stop for a fast moving market

An exit rule for when it goes close to your profit target but starts to drop (so you don't give back your gains)

Fundamental reasons to exit

Exit approach for once the price hits the objective and you think the move will continue (to capture big wins).

And many more

Understand the market type and act differently when it changes

One of the biggest mistakes that traders make is failing to build different trading systems for different market types.

A big part of trading what is in front of you is trading different systems based in different market types, or at least understanding how well your system works in other market types.

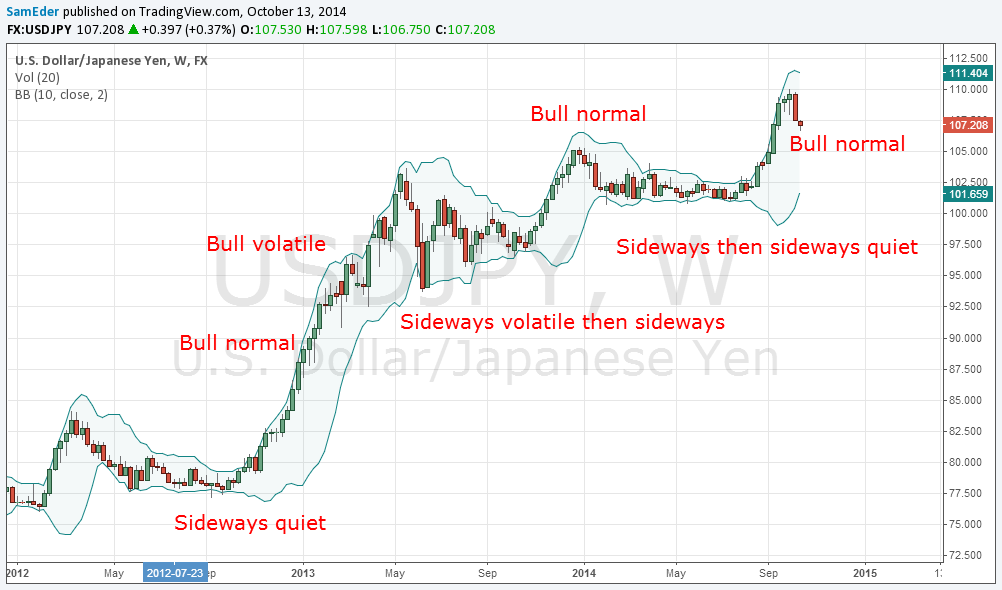

Take a look at this weekly chart of the USDJPY. You can see that if you traded the same system all the time, you would get drastically different results based on the market type.

Be very aware of the market type you are in and trade accordingly. I use Bollinger Bands to help me identify market types. More on that in the advanced Forex course.

Don't be the jester

Take the following steps to get started trading what is in front of you, and you will be well on the way to ruling your Forex realm.

Stop trading when you don't know what's going on

Come up with at least 3 new rules for exiting your trade after you have entered

Define the market type before you trade.

Want to learn more? Get Free Access to The Advanced Forex Course for Smart Traders.

About the Author

Sam Eder is a currency trader and author of

the Definitive Guide to Developing a Winning Forex Trading System and

the Advanced Forex Course for Smart Traders (get free access)