We can use the tech to define where shorts may really bail

The easiest way to get a real feel for a market is to look at the longer time frame charts.

Using the star of the moment, the pound, a look at the weekly chart puts everything into perspective. Before I get on to that, let's review what has actually happened.

Here's the GBPUSD CFTC positioning vs the actual price.

CFTC GBP positioning vs price

Among other things like BOE policy, shorts first started pricing in risk for the 2015 election. In the two weeks before the election the pound hit a then low around 1.4569, just after short positioning was at it's largest for the time. When the Conservatives cleaned up, and the economic recovery gained ground, risk improved and shorts got out. That was until we entered the next risk phase of Brexit into 2016. That's when the UK became a huge risk and players traded it accordingly by shorting the pound. The rest as they say, is history.

Let's break down the price moves.

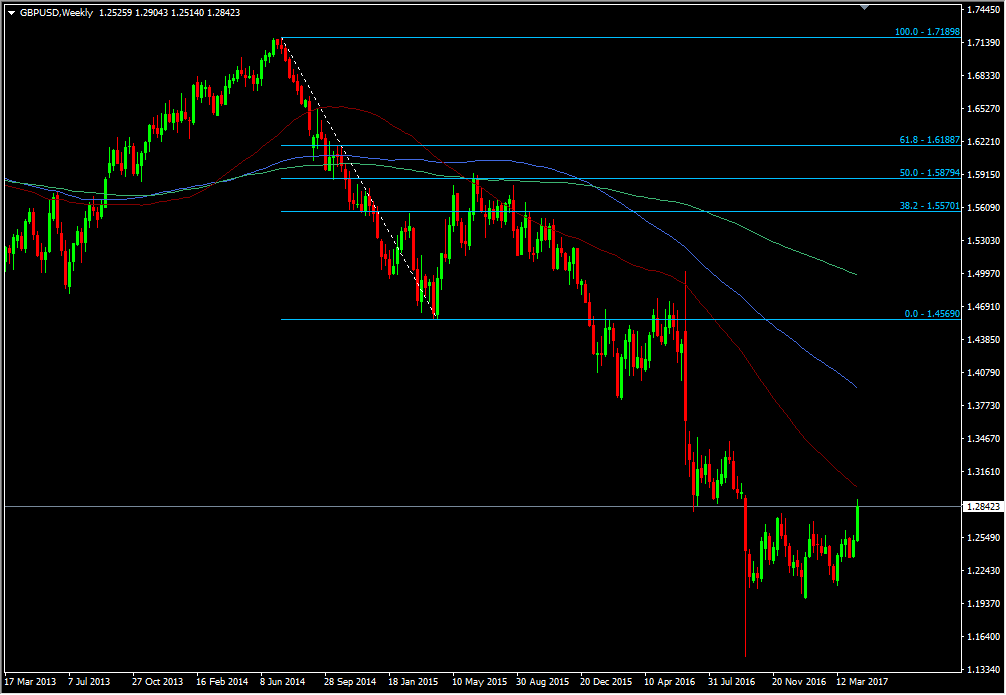

GBPUSD weekly chart

Taking the 2015 move, although positioning went back to modestly flat, the price could only recover to around the 50.0 fib of the move from 1.71. That move stopped buyers from building up long positions. The 200 wma was a factor too. Forget the positioning or fundamentals for a moment, technically the price failed there, and there was only one other direction to go.

So now we're entering 2016. The Brexit vote is the big event. Even before the result, the market factored in the risk of a vote to exit, not one to stay. The shorts built up as the price continued to fall. Then the BOE cut rates, which was icing on the cake, until the market found out that the BOE cut was just a short-term measure to get through the immediate months after the vote. However, positioning improved but the price didn't. That was very telling as it showed what was being traded. The BOE risk was removed but the Brexit risk wasn't. What was also happening on the USD side (Fed hike) was also helping keep the price low. The monetary policy divergence trade doesn't rank as high on the risk list so once we moved to that, shorts covered while the price stayed low.

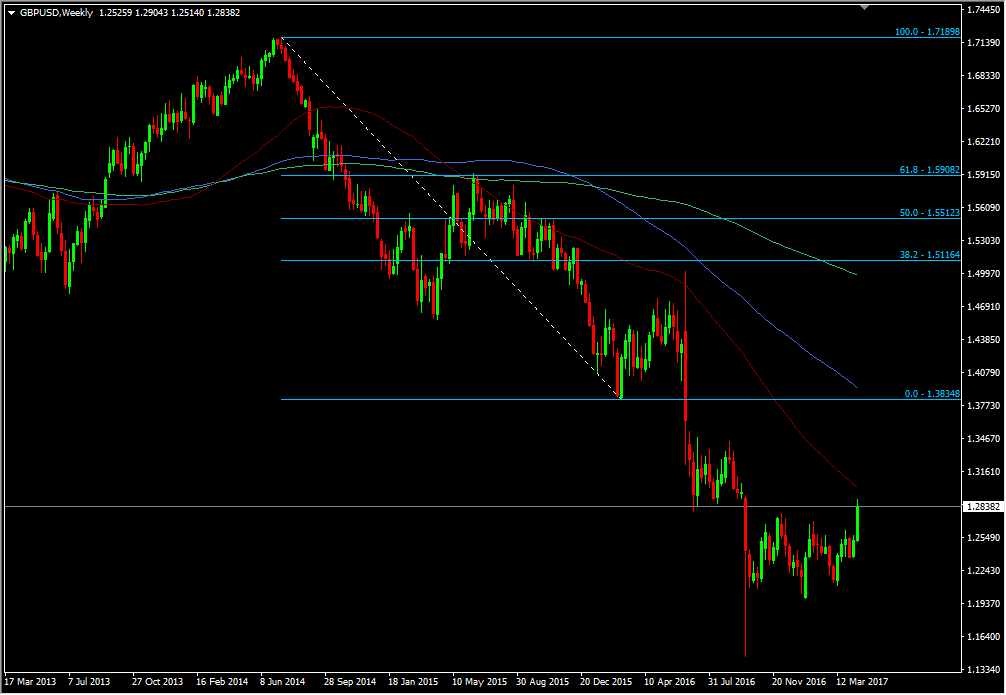

Again, we go to the chart and see that a fib from the 1.71 hi to the Feb 2016 low couldn't even reach the 38.2 fib.

GBPUSD weekly chart

The sellers remained in control and this time they weren't for turning. Brexit happened and here we are now.

And so we get to today, the day after yesterday. Let's break down the moves.

In reality, we've only had a 250 odd pip move, if you take out the nervous drop prior to the election announcement, and ignore the stop run to 1.2900, the real trading range has been 1.2600-1.2850. Additionally, we're been moving up since Feb anyway and have naturally broken a 6 month range.

GBPUSD 15m chart

So how does that factor into the short positioning?

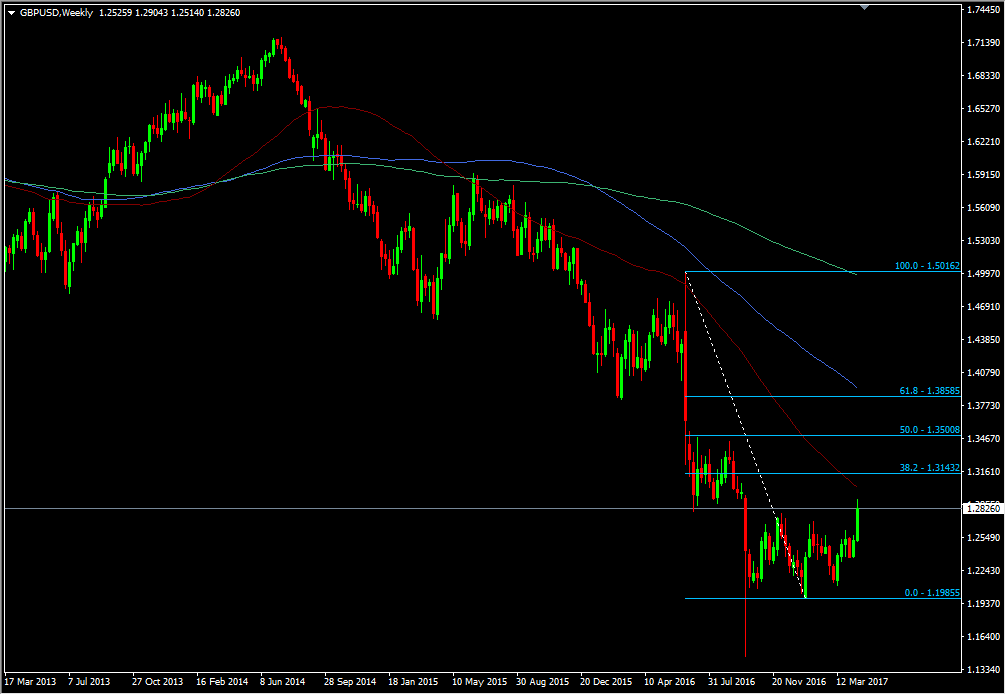

Let's get the fibs up again. We'll take a fib from the Brexit move to the 2017 low (I'm ignoring the Oct 2016 flash crash low as that low is still not clear on most charts/platforms).

GBPUSD weekly chart

We're closer than we've ever been but we're still some 300 odd pips away from touching the 38.2 fib of that move. And on a longer-term basis?

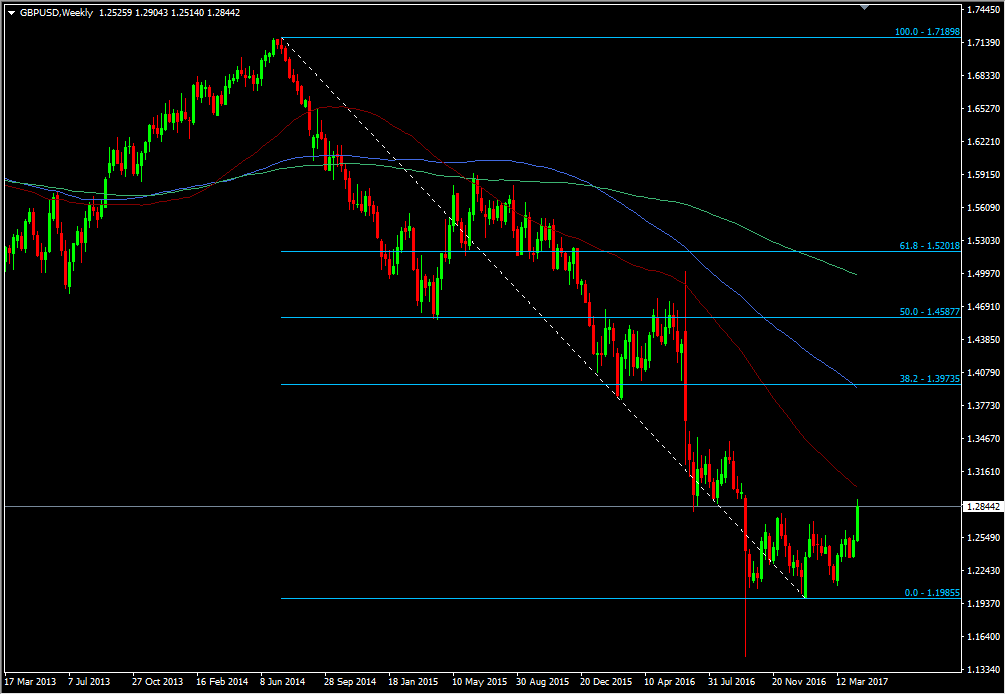

GBPUSD weekly chart

Not even remotely close to the 38.2 of the 1.71 drop.

But what does all that mean Ryan?

The reason I like fibs is that they tell a story that applies to positioning of all kinds, from 5 minutes to months and years. The 38.2 fib is the first place traders with positions ask a question. Those in the money use that level as an indication of whether the trade is still going ok or whether they need to take some profits off. It's an early warning signal that the price has made a concerted push away from a high or low.

The 50.0 fib is more important as it rings the alarm bell to say "hang on, this move has some legs now". It raises another question for those in positions seeing the price move against them. A break of the 50.0 fib usually tips more people out of positions as they feel that a 50% retracement is a sign that the original move is over. The 61.8 fib is the final shake out. It's the last line in the sand and if that goes, the towel gets thrown.

In the case of the current GBP short positioning, we are not yet near any levels where longer-term shorts would be remotely worried. If traders are sitting on shorts from mid to late 2015, even into the Brexit vote, they are still some 2000-3000 pips in the money. A one day move of 250 pips is not going to shake those trees. Hit the area between the 38.2 and 50.0 fib at 1.3974/1.4588 and we'll talk about short covering.

Stop the waffling Ryan, how do we trade it?

Adam nailed it yesterday when he said that it's likely that only short-term shorts got rattled in that move, and therein lies the crux of the matter and the most important trading point of all.

The huge short positioning isn't one man and his dog. It's hundreds if not thousands of trades and traders, all with different strategies and ideas. They may all be in the same boat but they all have different objectives while managing their positions. There's also plenty of option hedging involved too, so a good chunk of those shorts may not even be related to direct sentiment on the quid but rather as a result of option positioning that may be. There's such a huge amount of unknowns that we can't really trade it efficiently. No normal retail trader can trade a move from 1.71 to 1.19, (5200 pips) on one trade, and we certainly can't do it the other way.

Yes it is possible to catch long-term trends and moves but you need the fundamental conditions to be on your side, not positioning analysis. I don't even know what the EURUSD CFTC positioning currently is as it's irrelevant to my trading. All my longs care about is the fundamental picture and how large or small the risks are. If I'm happy with those, I trade. If positioning is against me and they get squeezed it's a bonus, not a strategy.

The pound could go to 1.35 or 1.55 or 1.15 but sitting right here in the here and now, that's all irrelevant. What will guide the price is the fundamentals first and the technical second. Short-term sentiment might change but that won't be enough to shake the long-term longs who are trading the Brexit risk. That is still the single biggest risk event and why we won't see the pound rise significantly until that picture becomes clearer. While that cloud lingers I'm in no rush to jump into pound longs or shorts, unless the charts give me levels I'm happy to trade. I lost money yesterday testing the rally and I quickly put my hands back in my pockets after.

While positioning is a great gauge of sentiment we can't really trade it except to be prepared that it might make the price move with greater volatility in one direction. If you feel the Brexit risks have waned, be my guest loading up on longs, the opposite applies with shorts.

As I wrote a few weeks ago, we're only at the beginning of Brexit trading, which is why I'm in no rush to jump in. If we are to take another huge leg lower, or recover a big chunk of the 1.71 fall, there's plenty of pips in there to take over the coming weeks and months, there's just no need to be in a rush to grab them.