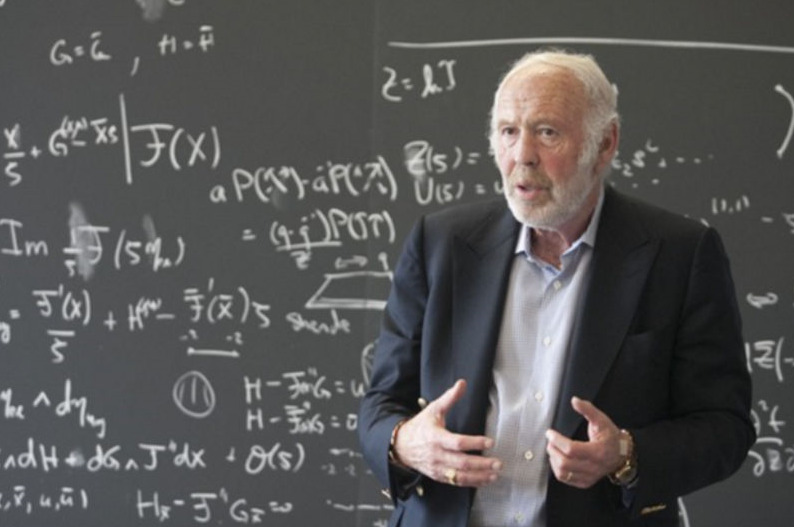

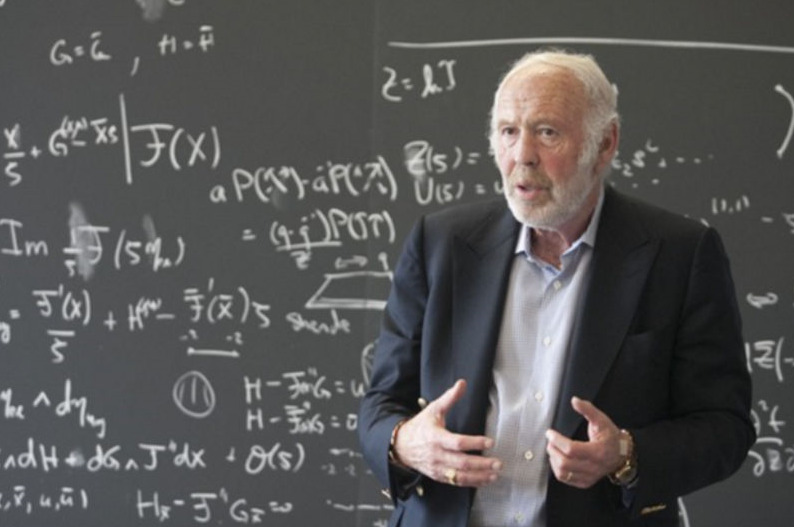

Jim Simons had modest wealth at 52; now he's worth $23 billion

Financial markets -- and risk taking in general -- are largely the domain of the young. Early adulthood is the time to swing for the fences while middle age is a time for prudence, perhaps risking a manageable part of the nest egg.

Yet that's not always true. It's particularly untrue of some of the world's greatest investors.

Among them is Jim Simons, the king of quants. Yesterday Gregory Zuckerman published "The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution."

It details how a 40-year old math professor walked away from a job at Stony Brook University to try trading currencies. He had no idea what he was doing but raised $4 million with a few partners. He recruited renowned mathematicians to help him. It didn't work and losses topped $1 million.

"If you make money, you feel like a genius," he told a friend. "If you lose, you're a dope."

He gathered more data and persevered through the 1980s with a mixed record. In 1989 he lost 4%.

Finally, Simons along with recently recruited colleagues Henry Laufer and Elwyn Berlekamp, started to focus on short-term patterns -- Monday's price action often followed Friday's, while Tuesday saw reversions to earlier trends.

It worked and the Medallion fund gained 55.9% in 1990. It hasn't stopped. His fund as generated average returns of 66%, racking up gains of $100 billion. No other fund or manager is even close. A $10,000 investment 30 years ago excluding fees would be worth $40 billion today. Even after fees, it would be worth $195 million.

How the fund makes money is one of the world's most-closely guarded secrets but it's story isn't. Simonds certainly had mathematical talents but he know almost nothing about markets when he started out at age 40 and managed to amass one of the world's great fortunes.