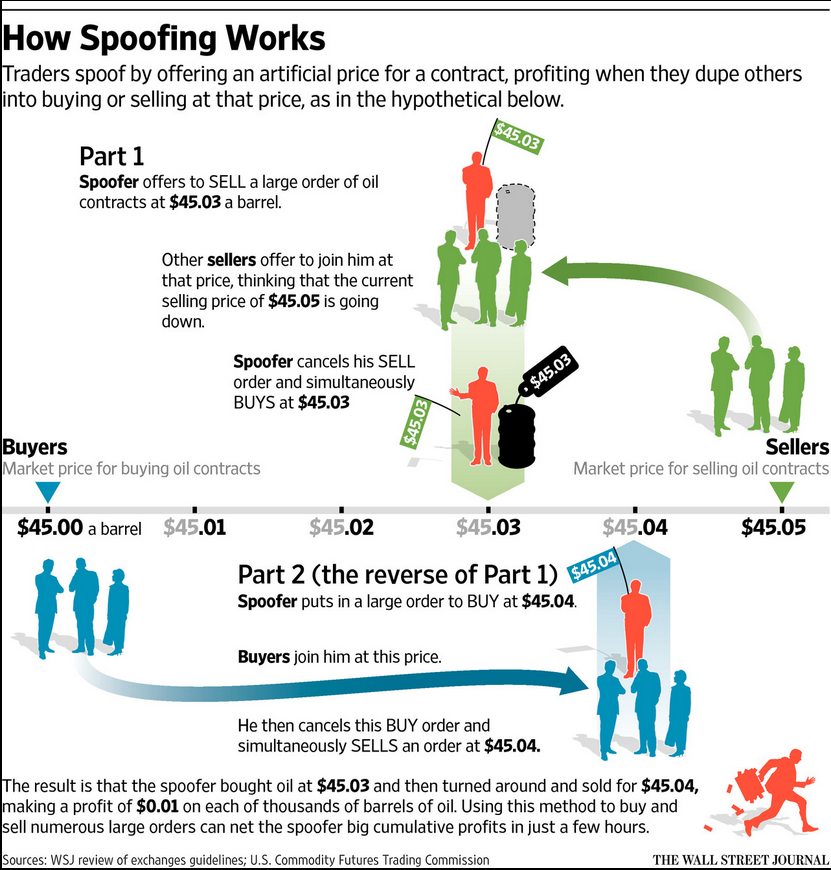

"Spoofing" the market is when a trader enters orders to make it look like there is more demand or supply than there actually is, with the intention of shifting the price and then getting the real order filled at a better price.

For example, in China officials allege spoofing on the stock exchanges of Shanghai and Shenzen.

The point about tricking the market into believing there is more demand or supply than there actually is, is that the 'spoofer' pushes a price in one direction before executing an order in the opposite direction.

For example a spoofer might place a huge amount of offers in the market ... other traders, seeing the deluge of offers might place their own sell orders looking for the price to fall, or indeed just sell by hitting a bid ... then the spoofer pulls his (or her) sell orders and executes a big buy order, so getting filled at a better price than otherwise.

What are your views on spoofing?

- Outraged?

- M'eh?

Whatever they are, it happens.

Here is more on how spoofing works.

Here is another great article on 'spoofing'. Want to know more about how markets work? Read this.