Patterns you must know

What is the daily closing price of Bitcoin? It doesn't have one. It is actively quoted 24 hours a day, seven days a week. Even the Euro closes at the weekend, but not Bitcoin. Most securities have a start and endpoint. What is the close of Bitcoin? may sound like an odd question, but it is crucial for Candlestick analysis. How can you have a Bitcoin Candlestick with no candle close?

Traders have used candlestick charting techniques for literally hundreds of years. We can say they have stood the test of time. Traders continue to use this ancient technique because it works. (If it did not work for them, they certainly would have stopped preferring to display their daily bars as candles long before now.)

The importance of a candle's close

Years ago, when Candlestick pattern analysis was developed, markets had a close. The close is the last trade or the settlement of the day or week. In those days, securities were traded on an exchange that opened in the morning and closed at the end of the trading day. There was no Globex session or overnight trade. If you wanted to initiate or close a position, it had to be executed during the market trading hours. The close of the day or week, therefore, takes on great significance. If you do not do your business during business hours, you have missed the opportunity until the next day. During the day, news comes out and is digested by the market. If the market looks like closing low given the news of the day, traders will bid it up. The close is, therefore, a conclusion of all the news and business of the day. It is a reference for the value of a security. The close has meaning.

We have a 'close' each day in Bitcoin. It is a time of day. It is just a snapshot of the price at the end of your day. Someone sitting on the other side of the planet has a different close. You see a Doji candle, and they do not. This is true of other cryptos and most other securities we trade today.

Candlestick analysis and Bitcoin

Could it be argued that there is no reason at all for Candlestick analysis to work in Bitcoin? Well, YES and NO.

YES, because the all-important closing price is just a meaningless value at a point in time. In the Forex market, you could say the same. The Euro does not close each day, but we give it a candle and interpret its pattern. At least it closes once a week - at the weekend. Friday's close is the conclusion of all the news, trading sentiment and fundamentals of the five days. It is the summing-up price of all that went on that week. It has real meaning. Imagine on a weekly chart, the market falling to test an uptrend line. Say the uptrend line is challenged, (and even breached) but ends the weekly Candlestick strongly and well above the uptrend line. During the week, traders tested the line, Stops were triggered, churning at, and even below, the trend line. But the market decided to hold the line, and the price advanced away from it. It finished well and above the line. The market concluding that the line will hold. We can justify the weekly candles in Forex.

In about 40% of the definitions of Candlestick patterns, the word Engulfing is used. This means the body of one candle is covered by the next one or is covered by the previous one. There has to be a gap at the opening and/or the close for this to happen. Bitcoin tradescontinuously. The opening of any candle is the close of the previous one. Therefore, there is never a gap. You will never see a Bearish Engulfing Line in Bitcoin. It cannot happen. A Bearish Engulfing Line requires that you gap higher on the opening and the body of today's candle completely engulfs (covers) the body of the previous candle. The Bearish Engulfing Line is one of the reversal patterns that tend to work well in other markets. Almost half the Candlestick patterns simply never occur, and there is an obvious reason why not - without gaps, you cannot be engulfed. Any explanation of a Candlestick pattern you may read on the internet or in a book cannot happen in Bitcoin.

NO, because clearly - for example - the message of a narrow-ranged Doji is that trading took place in a small range and ended where it started. This is an indecisive session in Bitcoin as well as anything else. It does not matter exactly where the close is - it is near the open. We have traded all day narrowly and went nowhere. If this follows, candles that were decisive with long bodies indicate a move from confidence to indecision.

About half of what you have learned about Candlestick charting works well with Bitcoin

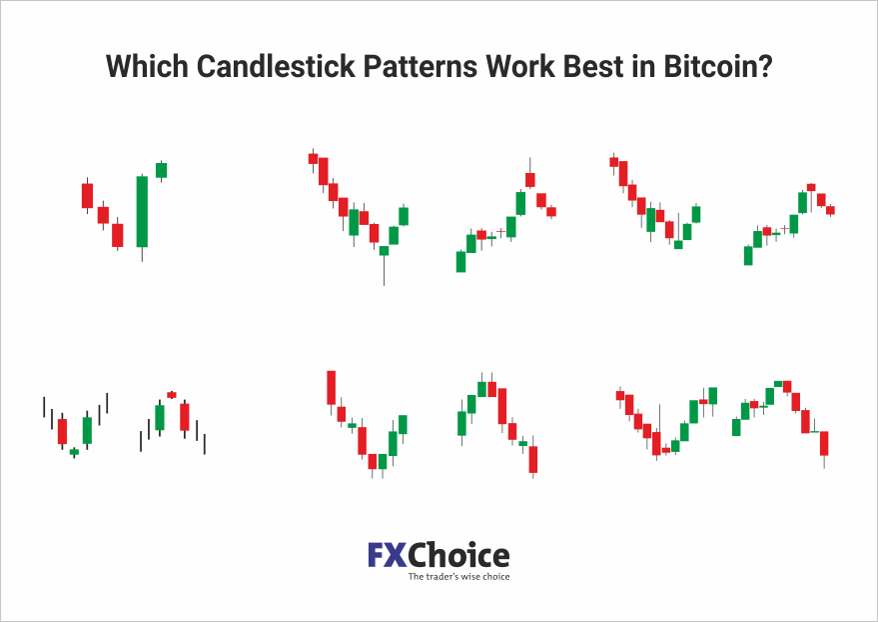

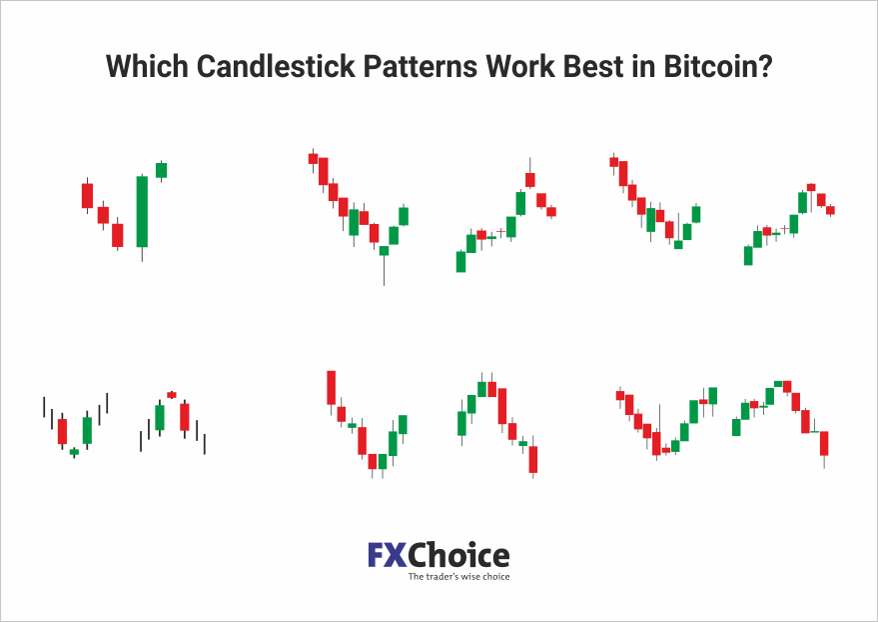

The candlesticks patterns which work in Bitcoin are the ones that do not require the candle's close to be in a specific place. If the candle's message is its context, body size, shadow position and range and candle colour, then the pattern message is just the same as you have read in the books.

Do some Candlestick Patterns work particularly well in Bitcoin?

In my testing of chart patterns and Candlesticks, I have found the ones which work logically work better in Bitcoin than in other markets. Bitcoin's price movements are not mostly driven by Fundamental news. There is very little actual news. The rises and falls are driven purely by the emotions of traders. Fear and greed drive the price. In other markets, fear and greed can sometimes be overwhelmed by supply, demand, inventory relationships, and news events. This is the reason technical analysis works better in Bitcoin than other securities. It has everything a technical trader would want - it is liquid and driven by emotions, unspoilt by random news.

Know the Candlestick Patterns

These patterns work best in Bitcoin and, sometimes, better than in other markets. Some Candlestick patterns will never appear or have no meaning in Bitcoin. You now know why that is.