For newcomers to the world of foreign exchange trading, one of the most crucial decisions is determining the optimal time to engage in the forex market. Unlike traditional stock markets, the forex market operates 24 hours a day, five days a week, presenting both opportunities and challenges for beginners. This article will explore the best times for novice traders to enter the forex market, considering various factors that influence trading conditions.

Understanding Forex Market Trading Hours

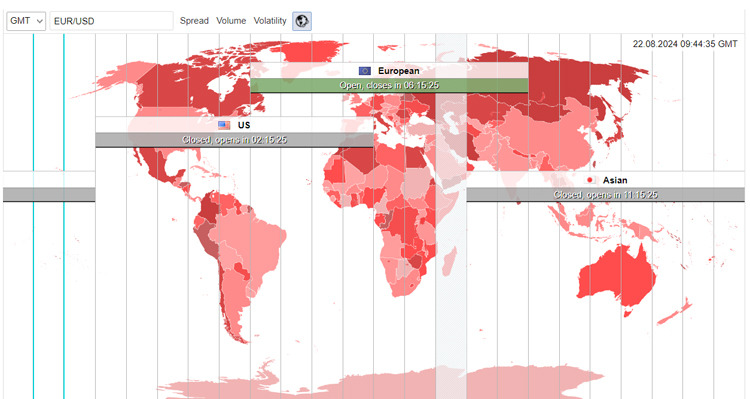

The forex market is unique in its round-the-clock operation, made possible by the global nature of currency trading. The market is divided into four major trading sessions: Sydney, Tokyo, London, and New York. These sessions overlap at certain times, creating periods of increased market activity and volatility.

Forex market trading hours are as follows (all times in Eastern Standard Time):

- Sydney: 5:00 PM to 2:00 AM

- Tokyo: 7:00 PM to 4:00 AM

- London: 3:00 AM to 12:00 PM

- New York: 8:00 AM to 5:00 PM

For beginners, it's essential to understand these session times and how they affect currency pairs and market dynamics.

The Importance of Market Overlap

The most active trading periods occur when two major sessions overlap. The two most significant overlaps are:

- London-New York overlap (8:00 a.m. to 12:00 p.m.EST)

- Tokyo-London overlap (3:00 AM to 4:00 AM EST)

During these overlaps, market liquidity and volatility tend to increase, providing more trading opportunities. However, beginners should approach these periods with caution, as rapid price movements can be challenging to navigate for inexperienced traders.

Best Times for Beginners to Trade

For those new to forex trading, it's generally recommended to start during periods of moderate activity. Here are some of the best times for beginners to trade:

- Mid-session trading: Trading in the middle of a major session, such as London or New York, can offer a good balance of liquidity and manageable volatility. This allows beginners to observe market movements without the extreme fluctuations that often occur during session openings or overlaps.

- Early US session: The period just after the New York session opens, from about 8:30 AM to 10:00 AM EST, can be suitable for beginners. By this time, the initial volatility of the session opening has usually settled, and there's still good liquidity in the market.

- Late European session: Trading during the latter part of the London session, from about 11:00 AM to 12:00 PM EST, can also be beneficial. This period often sees steady market activity without the intense volatility of the London-New York overlap.

Analyzing the Forex Trading Chart

Before deciding when to trade, it's crucial for beginners to familiarize themselves with forex trading charts. These charts provide visual representations of currency pair movements over time and are essential tools for making informed trading decisions.

Key elements of a forex trading chart include:

- Time frame: Charts can display price movements over various time periods, from one minute to one month or more.

- Price action: The main body of the chart shows how the price of a currency pair has moved over time.

- Technical indicators: These are mathematical calculations based on price and volume, helping traders identify trends and potential entry or exit points.

- Support and resistance levels: These are price levels where a currency pair has historically had difficulty moving above (resistance) or below (support).

For beginners, starting with longer time frame charts (e.g., 4-hour or daily) can help identify broader trends and reduce the noise associated with short-term price fluctuations.

Factors to Consider When Choosing Trading Times

When determining the best time to trade, beginners should take into account several factors:

- Your schedule: Choose trading times that align with your daily routine and when you can fully focus on the market.

- Currency pairs: Different pairs may be more active during certain sessions. For example, EUR/USD is typically most active during the London-New York overlap.

- Economic releases: Major economic news and data releases can cause significant market volatility. While these events can create trading opportunities, they can also be risky for beginners.

- Personal risk tolerance: Some traders prefer the higher volatility of session overlaps, while others may feel more comfortable with the steadier movements of mid-session trading.

- Trading style: Your preferred trading style (e.g., day trading, swing trading) will influence the best times for you to be active in the market.

The Importance of Practice

Regardless of the time you choose to trade, it's crucial for beginners to practice extensively before risking real capital. Many brokers offer demo accounts that allow you to trade with virtual money in real market conditions. Use these accounts to test different trading times and strategies, and to gain confidence in your decision-making process.

As you gain experience, you'll develop a better understanding of market dynamics and may find that your optimal trading times evolve. Remember that successful forex trading is a journey of continuous learning and adaptation.

FAQ

Is it better to trade during high-volatility or low-volatility periods?

For beginners, it's generally safer to start with low to moderate volatility periods. High-volatility times can offer more opportunities but also come with increased risk. As you gain experience, you may feel more comfortable trading during more volatile periods.

How important is it to consider time zones when trading forex?

Time zones are crucial in forex trading. You need to be aware of the active sessions and how they align with your local time. This knowledge helps you plan your trading schedule and understand when major currency pairs are likely to be most active.

How long should I practice on a demo account before trading with real money?

The duration can vary depending on individual progress, but most experts recommend practicing for at least 2 weeks on a demo account. During this time, focus on developing a consistent strategy and achieving profitable results before transitioning to live trading.

Can I trade forex part-time as a beginner?

Yes, many beginners start trading forex part-time. The 24-hour nature of the market allows for flexibility. However, it's important to choose trading times that you can consistently dedicate to market analysis and active trading.

This article was created using Dukascopy's advanced analytical tools.