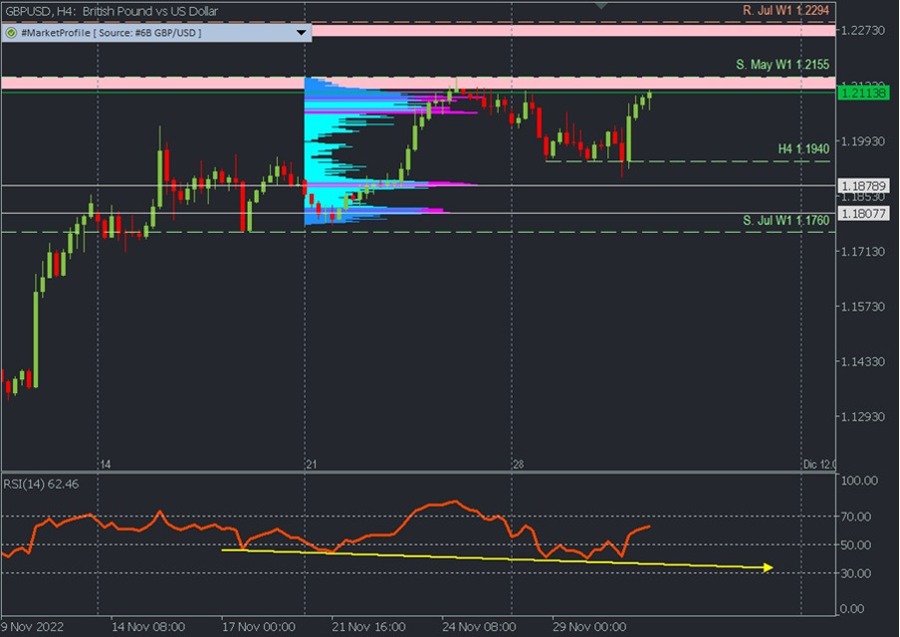

Main Scenario: Sell below 1.2150 towards 1.19, 1.18, and 1.1760 with SL above 1.22 at least 1% of account equity* Trailing Stop Applies

Alternate Scenario: Buy above 1.2155 towards 1.22 and 1.23 with SL below 1.2026 or at least 1% of account equity*.

Fundamental Scenario

The pound's gains in November added to October's 2.7% growth after Rishi Sunak replaced Liz Truss as Prime Minister, leaving behind her plans for significant unfunded tax cuts.

However, in November, GBPUSD was driven mainly by the US fundamentals that triggered the USD's corrective phase. In particular, the decline in US inflation made the Federal Reserve consider reducing the pace of rate hikes in the next meetings. The Fed Chair Jerome Powell has recently confirmed that prospect. As a result, bond yields dropped, and the dollar index experienced the deepest monthly dive since 2010.

What's on the pound's side of things? This week, the Bank of England (BoE) Chief Economist Huw Pill indicated that he expected inflation to fall "rapidly" in the second half of 2023. According to Pill, the central bank will have to keep raising interest rates to keep inflation at bay, but the borrowing costs may rise less than the market is pricing now, i.e., to 5.25%.

Although no rate change is expected at the next meeting on December 15, the BoE may increase its interest rates to 4.25% in the first quarter of 2023.

Macro scenario from Weekly chart

In November, GBPUSD achieved its biggest monthly rise since July 2020, breaking above the 1.1760 level, a supply zone from August and September that has now turned into support, so a retracement is expected towards this area in the short term as long as prices remain below 1.2155, May support.

The bullish scenario may continue in the short term if the selling zone is broken along with the 1.2155 level, targeting the July resistance at 1.2294. However, a more conservative scenario will occur after the retracement towards the 1.1760 level, from where we can expect a rebound towards the previously indicated highs with the possible breakout above 1.23.

The continuation of the annual macro bearish trend will occur when three events take place:

- The decisive break of the zone around the 1.1760 level activates the bears again.

- The decisive break of the 1.1145 support and, with it, the last demand zone of September.

- Bearish force toward September support.

The RSI Indicator above the midpoint in the positive zone confirms the current bullish strength in a bullish channel, the break of which will be another sign of confirmation of the entry of the bears.

Intraday scenario from H4 chart

After Powell's speech yesterday, the pair consolidated below the 1.2155 offer zone. As long as this zone is respected, sellers will keep trying to break the 1.1940 support and cover last week's high volume concentration points between 1.1878 and 1.1808. The GBP futures volume profile 6B is very close to the critical 1.1760 zone. The bearish divergence of the RSI supports this bearish idea in the short term.

On the other hand, the bullish scenario will continue if there is a decisive break of the 1.2155 sell zone, projecting towards the next offer zone under 1.2294. Likewise, after the descent towards 1.18, it is prudent to observe the strength or weakness of the movements to determine the bullish rebound or the bearish breakout and continuation.

**Consider this risk management tip

**It is very important that risk management is done based on the capital and volume traded. For this, a risk of at least 1% of the capital is recommended.

Disclaimer:

This article does not constitute a recommendation to buy or sell financial products and should not be relied upon as a request or an offer to participate in a transaction. This document is the author's economic research and is not intended to constitute investment advice, or solicitation of securities transactions or any other type of investment by FBS.

Although every investment involves some degree of risk, the risk of loss from forex trading can be substantial. Therefore, if you are considering trading this market, you should be aware of the risks associated with this product so that you can make informed decisions before investing. The material presented here should not be construed as trading advice or strategy. All prices indicated in this report are for informational purposes only.