Jacques Attali's dire future is fast becoming a reality: the imperial dominance of the United States is fading, and the dollar might soon turn into a pumpkin.

Oddly enough, the blame for this tectonic shift lies with the country itself. The decision to freeze Russian currency reserves consecutively prompted other countries hostile to the US to reduce the share of "greenbacks" in both portfolios.

According to the IMF, the dollar's share in central bank accounts fell by 0.44% to 58.36% by the end of 2022, the lowest level in 27 years. In absolute terms, the fall was 8.7% over the year to $6.471 trillion and in euros, 8.5% to $2.27 trillion.

Given that in the last month Russia, India, Brazil, Kenya, Saudi Arabia, UAE, ASEAN countries, and China announced their intention to increase the proportion of national currencies in their export payments, the situation could get even worse.

The idea of independence is also gaining prominence in Europe. Just this week, the French president suggested that the bloc should strengthen its autonomy vis-à-vis its big brother by reducing dependence on the "extraterritoriality of the U.S. dollar." What a turn of events…

What do the French propose? Among other things, to sign an agreement similar to the US Inflation Reduction Act (IRA). Macron also claims that Europe won the ideological battle to develop the continent's strategic autonomy.

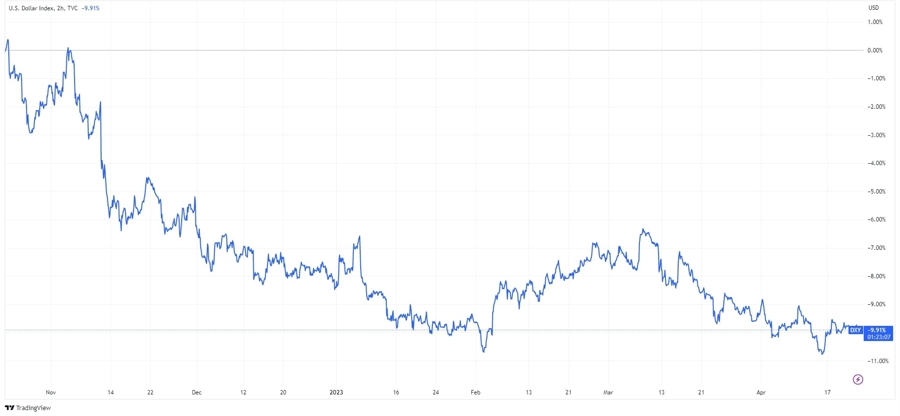

Further impetus to de-dollarization could be given by inflation or, rather, by the Fed itself. The new round of money printing will cause the supply of dollars to increase and thus lower the price of the dollar. The regulator's change in tone could also negatively affect the US dollar index.

So what can we do with this information? Although the situation does not look good for the US currency, this does not mean that it will disappear tomorrow. However, if the US economic situation worsens, one should think about possible safe havens such as gold (XAUUSD).