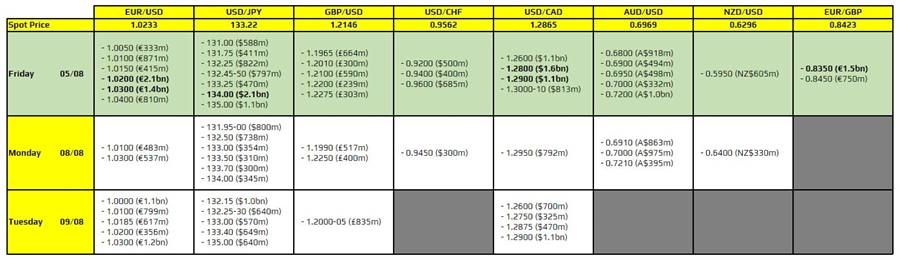

There are a couple to take note of for the day, as highlighted in bold.

Let's dive into the ones for EUR/USD first. The expiries at 1.0200 may help to limit any downside push before rolling off as they also hold close to the 100 and 200-hour moving averages at 1.0195-10 at the moment. Meanwhile, the expiries at the topside could limit gains alongside the 50.0 Fib retracement level at 1.0283. The latter in particular remains the key resistance point to watch on the daily chart.

Meanwhile, the one for USD/JPY at 134.00 while significant in terms of size, doesn't really play much into the technicals. That said, the 200-hour moving average is nearby at 134.10 and that was where gains seized up in trading yesterday. But I still the big picture range for the pair sitting between 130.00 and 135.00 mostly for now.

Then, we have some large ones for USD/CAD - which is sort of sandwiching price action at the moment. The ones at 1.2800 will be of keen interest in case there is a downside shove, before turning towards the 100-day moving average again at 1.2782 currently for support.

Besides that, there is also a large one for EUR/GBP but I don't see it coming too much into play given that it also isn't really pairing with any key technical levels on the charts.

For more information on how to use this data, you may refer to this post here.