- Prior 57.2. Revised to 57.1

- Employment index 54.0 vs 51.9 prior. Highest since May 2011

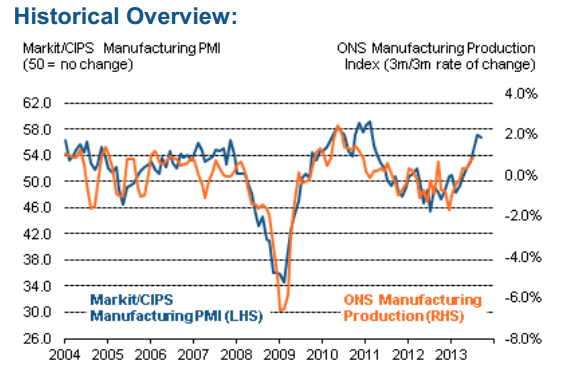

Despite missing the estimates the report still points to good growth in the sector. The employment index rising will be welcome news. Prices were noted as rising from August in both input and output, though purchase price inflation fell back a little more from the highs. Higher prices were seen in commodities, energy, fuel, dairy, paper and plastic. The good news is that selling prices have also risen. This has been a weight on profit margins as the rising input costs were not being passed on in the weak economic environment. If the prices are now being passed on then that puts businesses in a better position.

It’s all about sentiment and momentum. If the ball can keep rolling and pick up speed then the recovery can continue.

One downside to note is that exports rose slower than expected. Markits senior economist, Rob Dobson said;

“The main disappointment came in the form of a

slower rise in export orders. With the exchange rate

still around 20% weaker than before the financial

crisis, we would expect to be seeing far stronger

export gains than companies are currently

reporting, especially with the eurozone showing

signs of finally pulling out of recession.

Full report here; UK markit manufacturing PMI 01 10 2013