Well, we said a topside surprise for the CPI was likely … and that’s what we got.

AUD has been marked higher immediately, running straight into the offers at 0.8850 and thereabouts (more on the topside, higher up – see orderboard link for these).

The data:

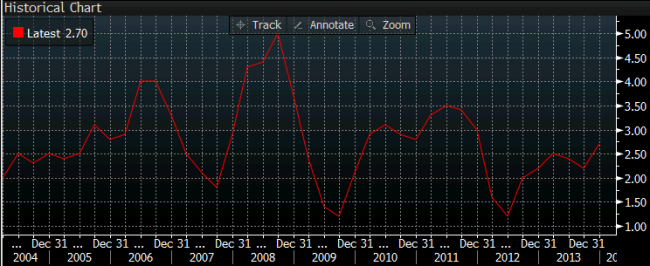

- Australia Q4 headline CPI: +0.8% q/q (vs. expected +0.4%, prior was +1.2%)

- For the y/y, in at 2.7% (expected 2.4%, prior 2.2%)

- Tradeables +1% y/y (-0.1% prior in Q3) and non-tradeables +3.7% y/y (prior+3.6% in Q3)

Australian headline CPI heading higher 22 January 2014. Y/Y results.

—

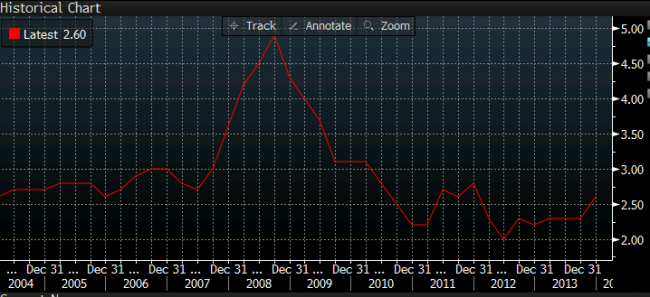

- Australia Q4 Trimmed Mean CPI: +0.9% q/q (vs. expected 0.6% and prior 0.7% q/q)

- For the y/y, in at 2.6% (expected 2.3%, prior 2.3%)

Australian trimmed mean y/y CPI results. this is the ‘core’ measure of inflation and it too is heading higher 22 January 2014

—

- Weighted median in at +0.9% q/q (expected +0.6%, prior was +0.6%)

- For the y/y Weighted median, 2.6%, (expected is 2.3%, prior was 2.4%, revised from 2.3%)

—

This data significantly reduce the chance of further near-term RBA rate cuts. While there is a good case to be made for continued cuts (see many of my previous posts, especially re sentiment/confidence declining, employment growth marginal at best, and so on) a rising inflation rate is not what the RBA wants. The recent fall in the currency (in the past weeks) will further add pressure to inflation going forward, should it be sustained. The most likely response from the RBA at this stage is to leave rates on hold for the time being, and for an extended period of time.

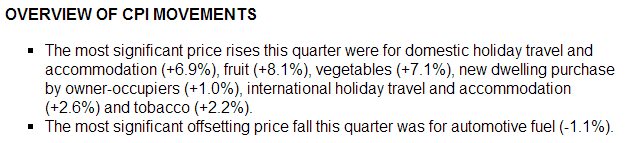

From the Australian Bureau of Statistics:

ADDED – Analysts reactions to the CPI