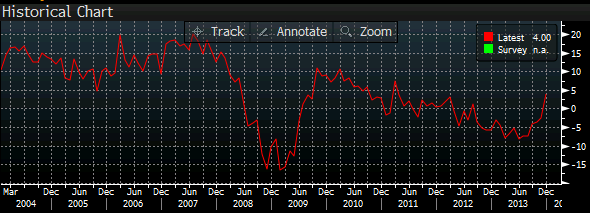

Business confidence:

- National Australia Bank business confidence for December: 6 (prior was 6, revised up from 5)

From NAB on confidence:

- “Confidence has remained surprisingly elevated following the post-election jump, and could potentially remain at these levels for longer than previously thought given that the conditions index has begun to respond”

- “Nevertheless, the increasing slack in the labour market and limited signs of a turn around in real activity indicators – in light of the looming declines in mining investment – suggests these improvements may be fleeting, although higher building approvals and recent signs of life in the retail sector are encouraging.”

- Confidence was relatively even across industries and the mainland states, with confidence positive for all industries, including wholesale which had previously demonstrated sensitivity to the Australian dollar outlook, the survey found.

—

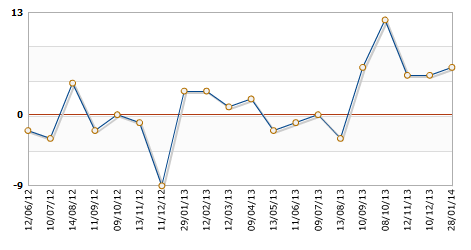

Business conditions:

- National Australia Bank business conditions for December: 4 (prior was -3) (yeah, I did a double-take on that one … that is a big improvement)

- biggest month-on-month jump since March 2011

- 2.5-year high

NAB business conditions

From the NAB on the big jump in conditions:

- The sustainability of the jump may be questionable given subdued forward orders, a run down in stocks (although this may be involuntary) and still low capacity utilisation

- most industries reported improved conditions, especially transport, wholesale and the services industries, but manufacturing and construction were notable exceptions

- employment conditions remain soft, at negative four points compared with negative eight points in November

–

Take a look at those two charts I pasted in … the trend in both is positive.

AUD/USD has reflected the improvements in the data immediately, currently up 25-odd points from the immediate pre-release levels (which had moved up 10 or so points in the minutes preceding the scheduled release time).