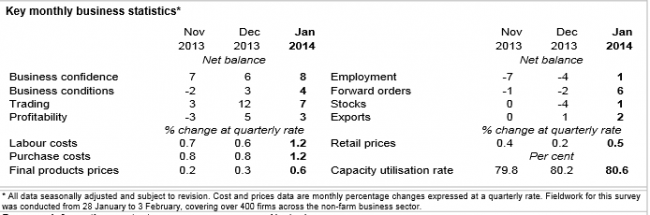

- National Australia Bank business confidence for January: 8 (prior was 6)

- National Australia Bank business conditions for January: 4 (prior was 3, revised from 4)

—

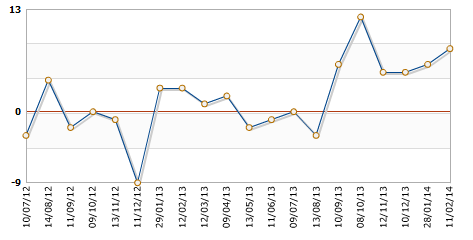

Business confidence posted its first rise in four months in January, now above long-run average levels

- Confidence is now positive for most industries

- But wholesale and mining are both negative

NAB chief economist Alan Oster said:

“Now that conditions are on the rise, confidence may continue its run of surprising post-election resilience for a while longer”

“Growth in forward orders will be supportive of the near term outlook, but the lack of much evidence of a turnaround in real activity indicators will probably keep confidence levels sensitive to any sign of headwinds from certain pockets of the economy, particularly mining investment or potential in housing construction.

“A continuation of slack labour market conditions will also constrain confidence in consumer-driven industries.”

—

Business conditions close to a 3-year high & close to long-run average of positive five points since 1997

NAB chief economist Alan Oster said:

“Conditions look to have turned around a little faster than we had expected just a few months ago, with low interest rates and the depreciating Australian dollar gaining surprisingly good traction in some non-mining sectors of the economy”

“The improvements over recent months have established a clear upward trend in business activity, suggesting some upside potential to our current growth outlook.”

- Manufacturing recorded a strong turnaround

- Improvements also in construction, followed by retail

- All other industries deteriorated

- Forward orders appear more supportive of better conditions

- Capacity utilisation remains below long run averages

- Employment index is still showing “a jobless recovery”

Oster again:

“It is probably still too soon to call the end of sub-trend economic growth in Australia based on these outcomes, but a rise in forward orders and capacity utilisation provides some comfort”

—