The data point is not a big focus of the FX markets, much of the focus today will be on retail sales, trade balance and RBA governor Stevens’ speech … but here it is earlier than scheduled time anyway.

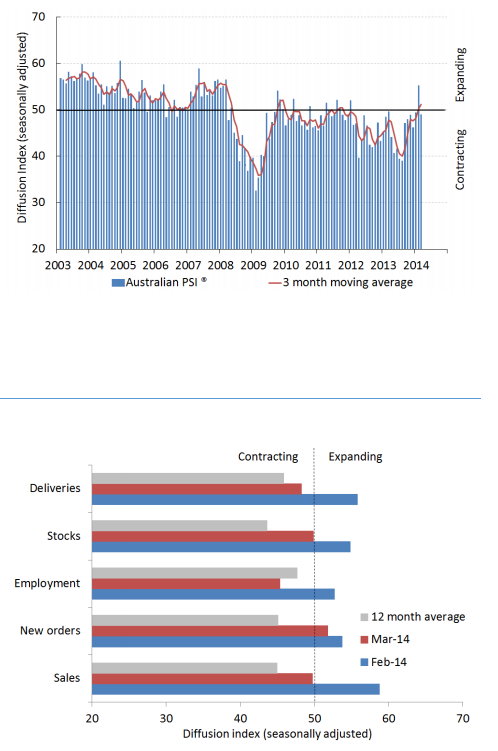

AIG Performance of Services index for March: 48.9 (prior 55.2)

- The largest decline m/m since April 2012

- Sales dropped 9.1 points to 49.7

- The employment sub-index contracted this month to 45.3 indicating that employers are cautious about the near-term outlook

- New orders grew – albeit at a slower rate (51.8)

- Growth continued to be concentrated in just a few services sub-sectors: health and community services (66.9 points); finance and insurance (62.6 points); and personal and recreational services (52.5 points)

- The large retail trade sub-sector declined by 1.8 points to 47.7 points (3 month moving averages)

- Input prices remained high (63.7) while selling prices continue to lag (45.6)

Ai Group Chief Executive, Innes Willox, said:

“The disappointing turn down in services activity in March is a sober reminder of the fragility of the broader economy. The services sector had lifted strongly in the previous month following a gradual buildup of momentum from the last quarter of 2013.

The latest Australian PSI, and the mixed results for employment and new orders, is a further reminder of the risk that excessive spending cuts in the upcoming budget could slow down domestic activity rather than encourage the private sector investment and employment creation that the economy require”

—

AUD/USD marginally lower (not much of a move at all)