I produced a video last night (after the opening in the Asian session) which talked to the virtues of the 1.6083 level (if prices can be described as having “virtues” – I never professed to being a wordsmith).

Anyway, that video is right here for those who may be interested in seeing it.

Now, the ideas in the video held up for a while (while I slept). The price of the GBPUSD moved higher -reaching a level of 1.6050 – but when the topic of Scotland came up , the pair took another tumble. As mentioned in the video, I thought (thinking tends to get me in trouble) that the market had seen “the devil” in the Scotland “yes” , so why harp on it going forward?

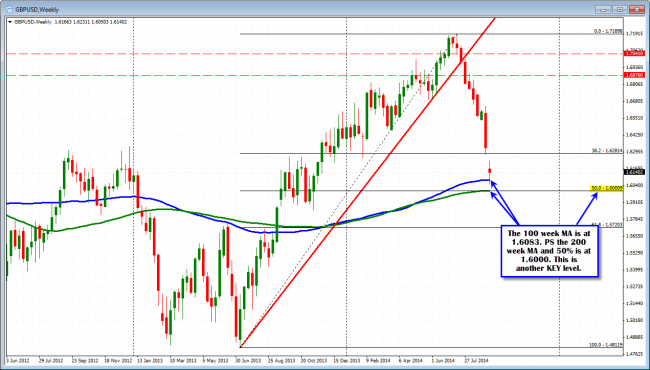

The 100 week MA in the GBPUSD is at 1.6083 this week.

Well, the market is still sensitive to the headlines, as evident from the quick move back below the 1.6083 level in trading today. This level happens to be the 100 week MA this week (see blue line in the chart above).

GBPUSD 5 minute chart is the window into the what happens at the 1.6083 level.

If you look at the break lower off of the Scotland comments, the pattern seen yesterday was repeated today. The price moved to the 1.6083 level – found a little support buying – then broke through the key 100 week moving average level and raced lower (see 5 minute chart above). The red areas in the chart above shows the moves from yesterday and again today. Like yesterday, the price quickly rebounded and then the market started to use the 1.6083 level as support. Like in the video, buyers came in – AGAIN.

Take a moment and watch the video and then look at the price action from the 5-minute chart above. “Price action is the window into the soul of the market”. If that blanket comment is true (I just made it up), that price action is telling me something about the “markets soul”. What are some of those things?

- The 1.6083 is a level of importance (that makes it a risk defining level)

- The market has seen “the devil” in a YES vote and the market is still scared (FEAR high)

- Many traders are getting whipped around.

So what now?

- We are away from the 1.6083. So no worry about quick moves from it.

- We also have been holding the 100 and 200 bar MA on the 5 minute chart above (after breaking higher).

- The 1.6125 level was a high level yesterday in NY/London and it was near our last low on that chart (see it).

- We failed on the break to new highs AGAIN (this is bearish)

Bias is higher intraday. I like more from what I see (there is a concern the high was not sustained). However, I too fear the devil now. So if the price should move below the 100 and 200 bar MA, I will likely exit the stage. If it holds, I would anticipate a rotation higher and look for an extension above the highs.