If you want a sense of how the Canadian dollar could break down in the next few days, look no further than the capitulation of the Australian dollar over the past four days.

The US dollar is on the warpath and with the FOMC still a week away, speculation about a hawkish tone will continue to fuel USD demand. There are some risks like tomorrow’s retail sales report but the way the dollar shook off a soft non-farm payrolls report is evidence enough to say the trend isn’t going away.

The Canadian dollar has been able to hang with the US dollar for the past two months because the strength in the US economy will spill over to Canada. But in trading terms, that’s a theme for another day. Right now the US dollar bull market looks unstoppable and it’s a matter of getting in where you can and hanging on for dear life.

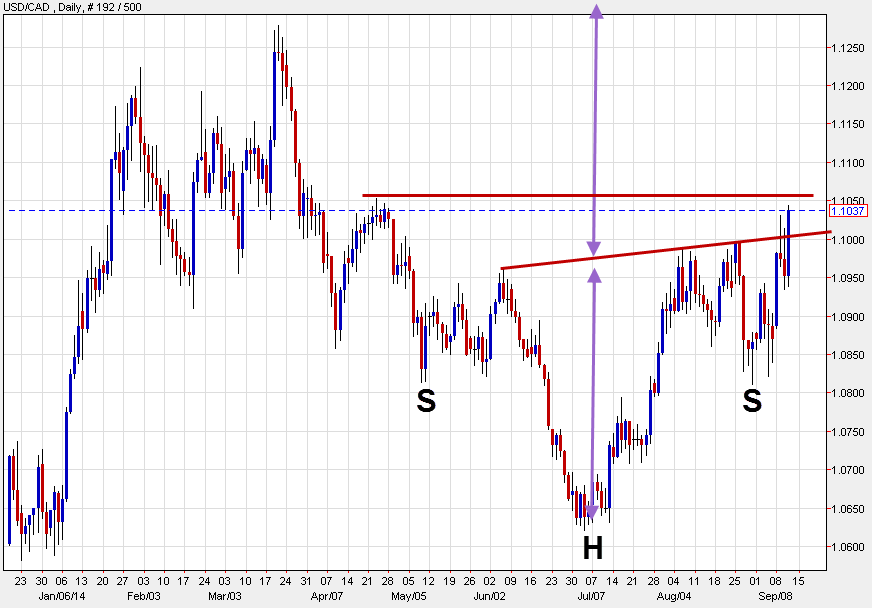

Technically, the pair has traced out an inverted head & shoulders patter on the daily chart that targets above 1.1300. The last chance for USD/CAD bears might be the 1.1053, which was the late-April high. If that goes, look out.

USDCAD daily chart