@Ricardo outlined the ranges for the major currency pairs for the year in a recent comment. His posting reminded me to take a look where we stand year to date and see if there are any clues we can take from history and reality.

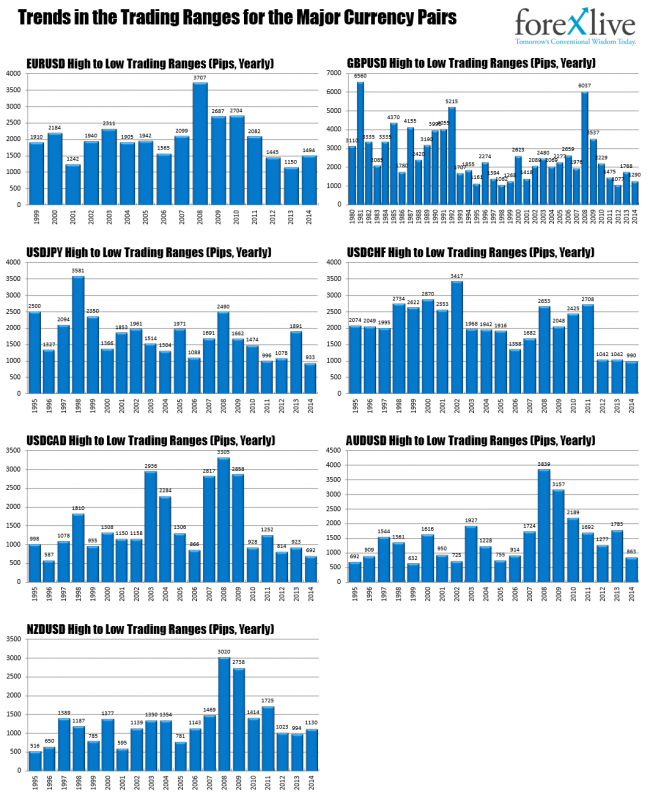

Below is a graphical representation of the history of the year ranges for the major currency pairs.(CLICK ON FOR A PRINTABLE PDF picture)

The high/low trading ranges for the major currency pairs by calendar year.

So what does it tell us as we head into the last 2 1/2 months of the calendar year?

EURUSD: Last year was a record low trading range year for the EURUSD at 1150 pips. Up until July, the pair was sitting in a 520 pip trading range for the year. That would have been 1/2 of the lowest range on record. So, that was a clue there was room to roam for the pair, and indeed, since July, the wheels have fallen off the EURUSD cart and the pair extended an additional 970 pips. At 1494 pips currently, the range is the 4th lowest in the history of the pair (going back to 1999 start). 2013 was non trend and that is supposed to lead to a trend. So is there another leg left down for the EURUSD before year end?. The average range for the EURUSD since 1999 is 2023 pips. That is another 500 pips which takes the pair down to 1.2000. Do you see it? Can the EURUSD get that low? There is a chance but it is less than what it was a few weeks ago.

GBPUSD: Range is 1290 pips. The low range going back to 1980 was in 2012 at 1077 pips Last year the range was 1768. This is the 5th lowest trading range going back to 1993 (22 trading years – the start of less volatile trading). Today the market extended the trading range for the year. There is room to roam and extend the range even further before now and the year end. With 1.7200 not likely the way, a move lower seems to be the most logical. The average range over the 22 years is 2079 pips. Not likely to extend that far from the current 1290 pip range. The median is 1915. Can GBPUSD move 600 pips or to 1.5300? Not sure about that (say 10%). The 1.5720 is the next stop. (61.8% of the move up from 2013 low). That would tack on another 180 pips to the year trading range. That might be it.

USDJPY: At 933 pips, this is the most narrow trading range going back to 1995. The average range over those 20 years was 1756 pips. The previous low range was 996 in 2011. All I can say is the move from the July low to 110.07 was certainly needed. That move extended the range for the year from around 465 pips to the more respectable but still record low of 933 pips. If we were to extend, would it be below 100.74 or above 110.074? Or do we have a record in the making? I think most would say 110.00 is the way to go.

USDCHF. The USDCHF had identical 1042 pip years in 2012 and 2013. Both were record low ranges. In 2014, the range is 990 pips. That would be a new record (at least going back to 1995). The USDCHF tags along with the EURUSD – keeping the EURCHF in check. The Swiss National Bank would like to see the USDCHF higher (PPI data was again weaker today). The high for the year is 0.9686. The high for 2013 was 0.9837 and 2014 was 0.9970. Surely, there is a 50 pip move above the high left to equal the 2012 and 2013 record low range? How about 150 pips to the 2013 high at 0.9837?

USDCAD: The 692 pips for 2014 is the lowest since 1996’s 587 pips. The next lowest was 814 pips in 2012. One would think, there is room to roam to the topside for this pair between now and Dec 31, 2014. Close your eyes and buy?

AUDUSD: Although the range of 863 is the lowest since 2005, there were other years with lower ranges. Then again, the AUDUSD has had more trading interest in the 2000’s vs 1990s. The RBA thinks it is still too high. Does the market buy that? The issue in October is September was so damn fast.

NZDUSD: At 1130 pips, the NZDUSD has surpassed the ranges of the last two years. The average since 1995 is 1285. Like the RBA, the RBNZ thinks their currency is too high. Yet they are the ones who raised rates in 2014. Will the data slow enough to squeeze the carry traders?

The problem, I see with the extensions, is the most logical path for all the currency pairs would be for a further rise in the US dollar. The Fed has been trying to slow that idea down. Absent the Fed muddying the water over the last few weeks, I might say 1.2000 in the EURUSD had a good chance. Now, although still possible, it is not as probable.

Nevertheless, if you think there is still “some” room to roam (i.e., some room for an extension), it might make buying a dip in the dollar easier on the corrections knowing this, and although we may not get 1.2000 in the EURUSD or 1.5300 in the GBPUSD, we might get a move to something lower than 1.2500 and 1.5900.