Headline CPI for Q3: +0.5 % q/q

- expected +0.4%,

- prior was +0.5%

For the y/y, +2.3%

- expected 2.3%, prior 3.0%

–

For the ‘trimmed mean’ (which is the measure the RBA pays most heed to):

For the q/q: +0.4%

- expected 0.5%,

- prior 0.7%, revised from 0.8%

For the y/y: +2.5%

- expected 2.7%, prior 2.8% (revised from 2.9%)

–

Weighted median CPI: +0.6% q/q

- expected is 0.5%, prior was 0.6%

For y/y: +2.6%

- expected is 2.6%, prior was +2.6% (revised from2.7%)

–

The RBA might have 99 problems, but inflation ain’t one.

Well within the target band.

Even the prior trimmed mean and weighted median readings revised down.

–

OK … so that’s that then. We get the next inflation numbers from Australia way off in January next year (the 28th).

So, we got 3 months to prepare for that … but here is an early heads up on what the result will be on a y/y basis .. it’ll be even lower!

Why?

Well, the Q4 2013 result was +0.9% q/q (for the trimmed mean) … and that’s gonna dropout of the yearly inflation result. Soooo – no inflation worries for the RBA.

(ps. ‘Favourite/bookmark whatever this post – it will come in handy if I am wrong – you can rub my nose in it)

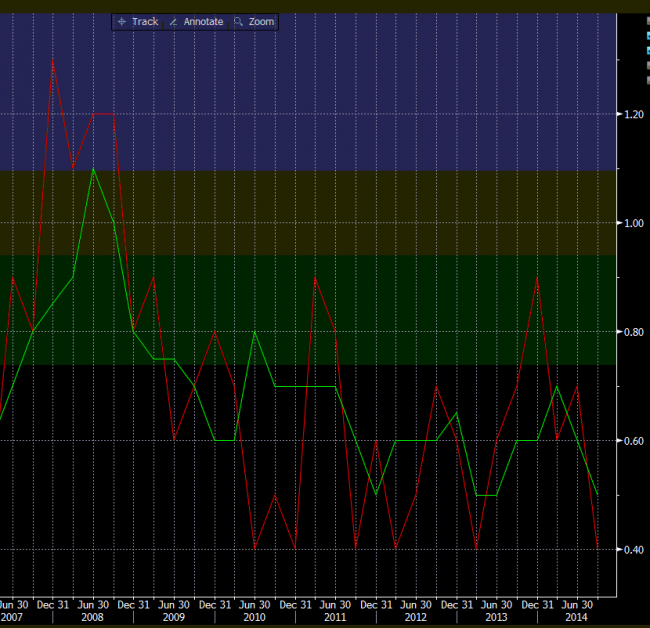

Check out the graph (red line is the actual, gereen line the ‘expected’):

Inflation falling + add in macroprudential tools to address the house price/financing issues = no rate hikes for a very loooong time in Australia.