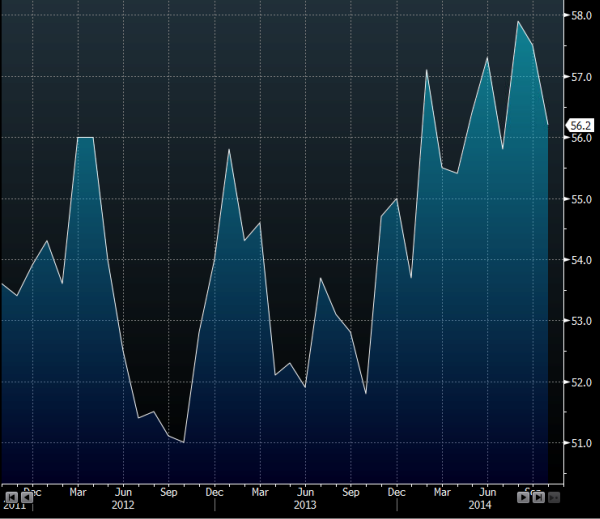

- Prior 57.5

- New orders 57.1 vs 59.8 prior. Lowest since Jan

- Output 58.0 vs 59.6 prior. Lowest since March

The headline is the lowest since July. That’s taken the wind out of the current USD/JPY rally, but for how long? We’ve seen manufacturing weakening all month since the Empire State report so this fall is not unexpected. For all the good reasons I pointed out in my yen post here’s a reminder that there is a very big area that’s looking like it’s starting to underperform. Still, theses numbers are coming off a high point and are still well into expansion so no real alarm bells needed here just yet.

US Markit manufacturing PMI flash 23 10 2014

Up next is one of my favourite numbers, the Eurozone consumer despondency index. Happiness is expected to fall further to -12 from -11.4