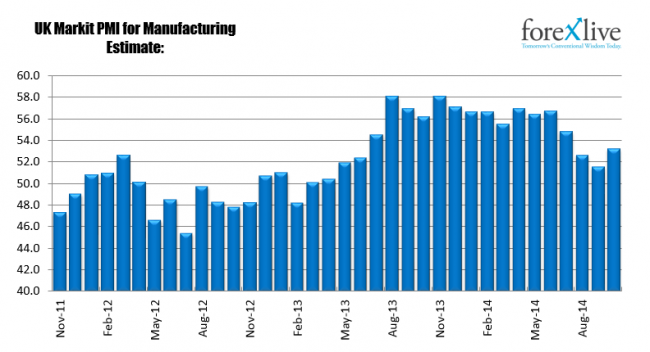

The GBPUSD got a boost from the PMI data this morning. It was higher than expectations and last month,but apart from the last two months, it is at the lowest level since July 2013. So some good in that it recovered and some bad, that it remains lowish.

UK Markit PMI comes out better than estimates at 53.2 vs 51.4.

The pair moved higher but found resistance in that area that we have been focused on for the last 6 trading weeks. Yes the 50% and the 200 week MA are once again in play. The 200 week MA comes in at 1.60206 this week and the high print I have comes in at 1.60199.

The price has traded above and below the 50%, the 200 week MA and 100 week MA for 5 weeks in a row. The high today stayed below the 200 week MA at 1.60206.

Did the sellers show up and tip their hand by leaning against the level and pushing the price below the 1.6000 level again?

Yes. I give the nod to the shorts right now. I can say that.

However, is there more to prove? The answer to that is also YES.

What I am not impressed with, from the sellers perspective is that on the last three pushes below the 1.5950 level, the price has spend 4 hourly bar below with only one close below (that was earlier today). That is not awe inspiring.

GBPUSD on hourly chart shows some reluctance above 1.6027, but also a reluctance below 1.5950 .

This week, we will decide if > 1.6027 or <1.5950 will happen. If you are more bearish, You can probably lean against the 1.6000 level too (RISK defining level today). So sell against that area or more patiently against the 1.6027 area. IF you are bullish, lean against the 1.5950 level below. Those are my “lines in the sand” as we start the trading week. If you want to play the range (until the break) you can do that too.

I am more bearish (I still anticipate a move away from the 200 week/the 50%), and apart from 4 bars over the last three trading days, the price is below that area, but it is not impressing me much (but still has the potential to do so.