The US November CPI report is due at 8:30 am ET on Wednesday (1330 GMT), here’s why it could overshadow the FOMC decision.

The dynamics of the Federal Reserve decision could dramatically change because of the consumer price index data a few hours before the decision. If the numbers are soft, they could severely diminish the chance the Fed removes ‘considerable time’ from the statement.

All the focus is on the wording of the Fed statement but all the Fed’s focus is on inflation. With oil and commodity prices cratering, there is no rush for the Fed to hike rates.

The consensus estimate is for a 1.4% y/y rise in overall inflation and a 1.8% y/y rise in core figures (excluding food and energy). The later will be more of a focus for the Fed because the debate around the table will be on whether the boost to consumer spending and the economy because of low gasoline prices will stoke inflation elsewhere. Then again, if overall inflation is extremely soft, it will filter into the core numbers later.

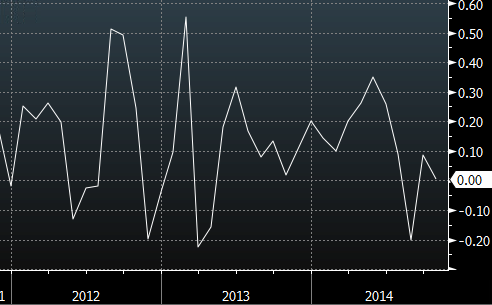

Headline m-m CPI

On core y/y inflation, the consensus is packed extremely tightly. Estimates range from 1.7% to 1.9% among 42 economists surveyed by Bloomberg. That kind of tight consensus can catch the market off guard.

If core and headline numbers are soft, look to sell the US dollar — but not against the yen. It means the Fed is less likely to remove ‘considerable time’ and that will boost stocks, which will keep USD/JPY buoyant. The best bets are probably AUD, CAD and GBP.

If the inflation numbers are strong, it may leave the Fed with little option other than to shift to a more hawkish bias. Look for broad and sustained US dollar strength.