Views from 15 banks on what the FOMC will do

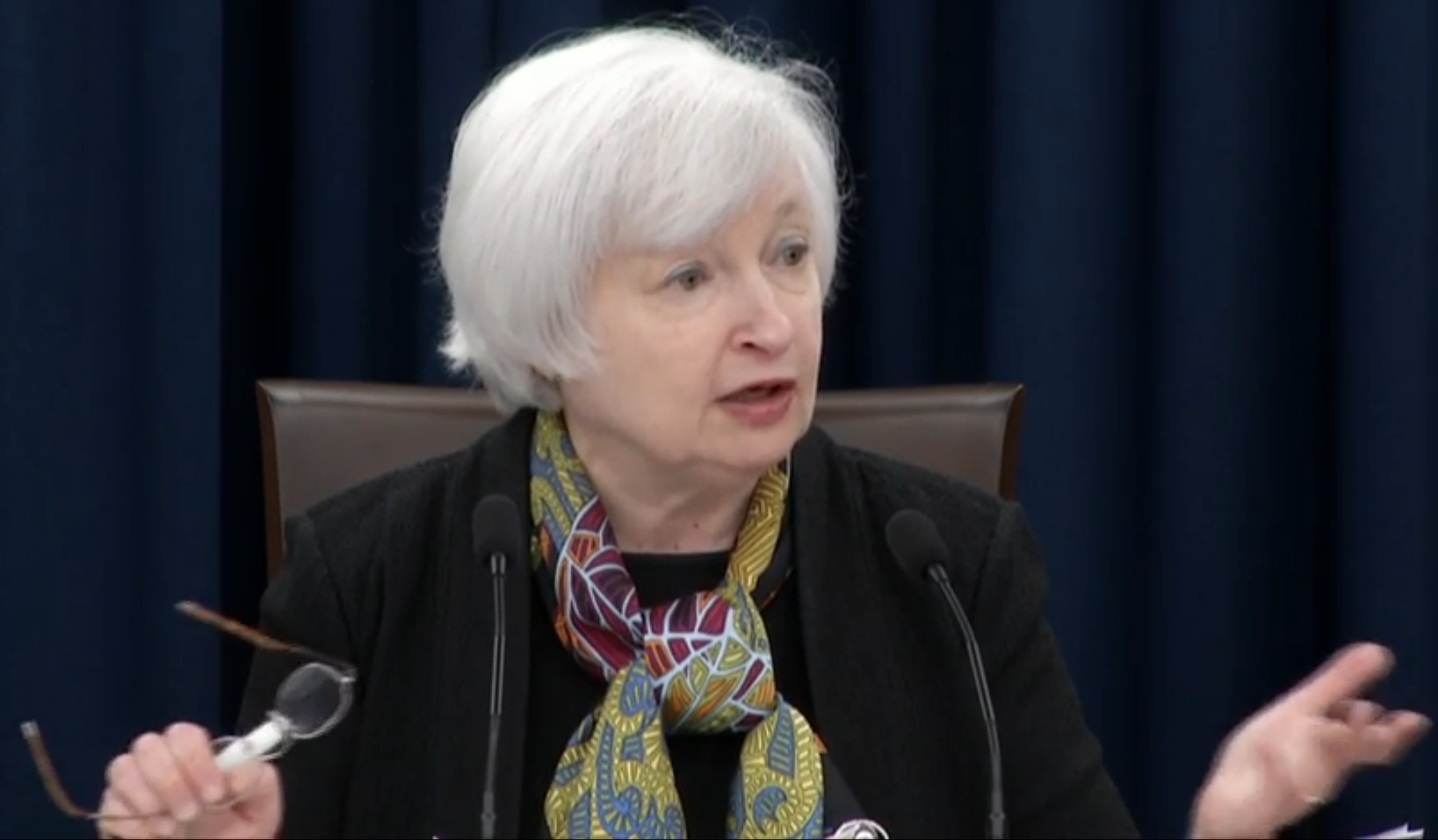

Here are snippets from 15 banks on what they expect from Janet Yellen and the Federal Reserve today.

BNPP (out-of-consensus): FOMC To Announce A Dovish Hike; Mkt Short USD Into FOMC

Our economists continue to forecast the Fed delivering a 25bp 'dovish' hike, cushioning its delivery with reassurances about gradual tightening going forward. However, even a 'dovish' hike would show the market that the Fed are willing to tighten even when very little is priced in and hence the premium attached to all upcoming meetings would need to re-price higher. With the market short the USD, we expect to see a significant strengthening of the USD if the Fed delivers. If the Fed does elect to leave policy unchanged, the USD is likely to take a leg lower with AUDUSD attempting to test 0.7650 and EURUSD 1.1250. However, we would expect the accompanying message to keep a December hike in play (currently priced at 55%%) and hence we would not expect the USD sell-off to extend too far after the initial adjustment.

Barclays (out-of-consensus): The Time Has Come For A Fed 's Hike

The time has come The long-awaited September FOMC meeting has finally arrived, and we retain our call for a rate hike on Wednesday. Mixed economic data last week, including disappointing retail sales amid a solidifying CPI, coupled with dovish commentary by Board members Brainard and Tarullo, have reduced market expectations of a hike, with a 20% probability priced in. We see the likelihood of a hike as higher than market pricing, and there is scope for material USD strength if the Fed delivers. If the committee instead stays on hold, more hawkish members will need to be placated with stronger language that points to a December rate increase. We would expect limited USD potential downside if this is the case. The market will also pay attention to the FOMC's Summary of Economic Projections. We foresee a 25-50bp decline to the appropriate policy path, the ''dot plot''. We think the median member sees conditions as likely to support only one hike this year, and the appropriate policy path is likely to decrease by 25bp in parallel in 2017 and 2018. Given the very shallow rate path already priced in, the downward revisions should not have a meaningful effect, in our view. Finally, we expect a 25bp shift down in the long-term fed.

BTMU: No Urgency For A Fed Hike; Downside Risk For USD S/T.

With the probability of a rate hike so low, we fail to see the urgency in Yellen going in circumstances of causing a disruption to financial market conditions when we are now within two months of a presidential election...We also find it hard to envisage a "hawkish hold" this evening given the DOTS are likely to be cut for this year and next year and with the long-run fed funds rate probably coming down from 3.00%. Sure Yellen will signal a December rate hike with one DOT for 2016, but will the market believe it? We see downside risks for the dollar over the short-term.

Credit Agricole: No Change; USD Tends To Weaken Post-FOMC But This Time Is Different

We expect no change in policy from the FOMC but we see the September meeting as setting the stage for a rate increase in December. The market is going into the event with a 20% chance of a hike priced in - higher than any of the previous meetings this year but still too low in absolute terms for the Fed to hike without fearing that the move will significantly surprise the markets, triggering some undesired volatility and a tightening in financial conditions. Amid conflicting messages from Fed officials, our economists argue that while the Fed is closer to a hike, there is not enough consensus in the committee to move in September given that there has been relatively little additional progress on inflation since the July meeting. The USD has weakened after every FOMC meeting this year but we believe this time may be different. Market-implied probability of a hike by year-end stands at around 55% - a more hawkish Fed statement should push these expectations higher even acknowledging the risks surrounding the November presidential elections. Any downward revision to the terminal Fed funds rate raises questions about the dollar's long-term performance but we don't believe it will hurt the greenback much in the near-term given the flatness of the front-end of the US yield curve. That is, near-term hike expectations should sustainably lift the US 2Y yield, increasing the dollar's yield advantage. After a long period of disappointment with bullish USD strategies market positioning is not particularly long dollars, which should play into the greenback's advantage, at least in the near-term.

SocGen: Pricing December Hike With Conviction; USD positive.

The short-term key to yield differentials comes with today's FOMC announcement. we think it's now consensual (a few outliers notwithstanding) that the FOMC will encourage the market to price in a December hike with more conviction, which in turn 'ought' to underpin US rates/yields and be at least a little dollar supportive.

Lloyds: On Hold; Dot Plot To Point To December Hike.

Markets currently attach only a 20% probability to a tightening in US monetary policy at this week's policy meeting. Of more interest is what signals are sent about the Fed's policy intentions for the rest of this year. Most FOMC members will probably want to indicate markets are paying insufficient attention to the risk of a rate rise. The 'dot plot' of policymakers' interest rate predictions will likely show the majority expecting a rate rise in December. The message may be a tempered, however, by a minority forecast of unchanged interest rates.The low probability markets place on a near-term rate hike leaves the risks to the US dollar and Treasury yields tilted to the upside.

Goldman Sachs: Probability Of A Fed Hike Less Than 5%

Later today will bring the much-awaited September FOMC, in something of a one-two punch of central banks. Our US economists put the chance of a hike at less than 5 percent, but see the cumulative odds of a hike by December at 65 percent, basically in line with what interest rate futures are pricing. As a result, they expect a hawkish pause, with the "nearly balanced" language perhaps making a comeback. They expect the dots to show fewer hikes, with the median dot going from two to one for 2016 and from three to two in 2017, i.e. two less hikes through 2018. However, they expect the long run median dot to remain at three percent.

Credit Suisse: FOMC On Hold; Recent USD Strength Perplexing.

The market and policy context of this latest bout of USD strength is particularly perplexing as it follows a highly anticipated and remarkably dovish speech by Fed Governor Brainard ahead of the upcoming 21 September Fed meeting. The unwind of the buildup in hawkish expectations triggered by the speech had a remarkably short-lived impact, as it did not prevent US rates from selling off in line with the rest of G3 (Figure 3). Our US economists expect the Fed to remain at the upcoming meeting.

BofA Merrill: Fed To Send Conditional Hints Of Upcoming Hike; Mildly USD Positive

The "cautiously hawkish" tone that we expect from the FOMC meeting is likely to be mildly USD-supportive, but we doubt it is the start of a new trend. An upbeat economic assessment and nearly-balanced economic risks would support market pricing for a December hike, limiting USD downside, in our view. However, with the market pricing just over one hike between now and end-2017, we believe a necessary condition for the USD to rally is a consistent pattern of better US data allowing the market to price a meaningful pace of hikes in 2017 and 2018. Until then, the USD is likely to be range bound. That said, a residual expectation for Fed hikes is likely enough to limit significant USD downside given most G10 central banks are easing, but the dollar is unlikely to rally either.Additionally, the recent shift by our US Rates Team's to a short real rates stance also suggests USD risks are more on the upside than the downside. The USD has benefitted over the past week as US real yields have risen between 6 and 18 basis points, driving a steepening of the rates curve. While the USD is typically negatively correlated with the shape of the yield curve, it has rallied because the curve steepening has been driven by real yields a relationship we have highlighted on many occasions. Should a real rate-led steepening of the curve continue, we would expect the USD to benefit. Indeed, the dollar continues to look undervalued relative to real yield differentials as we have noted recently.

RBS: FOMC On Hold; No Strong Directional Conviction

Recent soft economic data has made the FOMC meeting less of an anticipated event, but the statement, dot plot, and Yellen's post-meeting press conference will still be scoured for clues as to how strong the Fed's desire is to raise interest rates later this year. Our baseline scenario for the FOMC decision is consistent with current market pricing, and thus we do not have strong directional conviction from that event.

JP Morgan: Next Hike In December; USD Unlikely To Fall On Any Dot Plot Drop.

With respect to the FOMC, we continue to look for the next hike in December. While recent rhetoric has increased our confidence they won't hike in September, it has left our confidence in December unchanged. Firmer inflation data would obviously make us feel better about that call. We will also look to next week's dots for a sense of how the Committee is feeling about the outlook. In June every participant was anticipating at least one hike this year. We would not be surprised if that changes and there were at least one participant next week anticipating zero hikes. Recall that the dollar has always fallen and bonds rallied after an FOMC press conference when the Committee lowers the dots, but the magnitude and duration of those move have always depended on the global context. In an environment where US activity data looks stable on average and where most inflation measures are moving higher, we doubt that another dot drop would weaken the dollar much.

RBC: Relatively Unremarkable; A Dovish Hold

There is a widespread expectation that the outcome of today's meeting will be a "hawkish hold". We think the risk is the tone of the press conference and revised forecasts fall short of expectations. Our economists think the statement itself should prove to be relatively unremarkable, although a modest downward tilt to the characterisation of the economic backdrop is likely in the offing. They think the dots will shift lower, reflecting the removal of another hike this year, although the committee is likely to keep the "optionality" of a 2016 increase alive. Yellen's press conference should lean on the dovish side given the recent bout of soft economic numbers.

ANZ: FOMC On Hold; Dot Plot To Be Revised Down

For the FOMC, expectations are that rates will be kept on hold. Whilst levels of resource utilisation in the labour market could justify a rate rise, headline inflation remains significantly below target and activity readings on the economy have been at best patchy recently. Central case expectations are that the dot points will be cut by 25bps and the FOMC will maintain its optionality by leaving one rate hike in for December. If the FOMC maintains its view of three hikes next year and in 2018 that would automatically lead to a reduction in the median estimates of fed funds for those years. Following the disappointing growth outturn in the first half of this year, there are downside risks to this year's growth forecast (currently 2.0%). Forecasts for 2019 will also be published.

Nomura: FOMC On Hold; Next Hike In December.

We do not expect the FOMC to change policy this week. FOMC participants continue to stress that their policy decisions are "data dependent." The economy's performance in the first half of the year was relatively weak. There is some evidence of a pickup in recent months, but the latest data suggest that activity slowed at the end of the summer. We think the FOMC will need to see a more sustained acceleration of economic activity before raising rates again. That said, many FOMC participants, including Chair Yellen, have argued that "the case for an increase in the federal funds rate has strengthened in recent months." Given these comments, we cannot rule out a rate increase this week. Based on our forecasts for growth of a little above 2 percent in the second half of the year, we expect the FOMC to raise its targets for short-term interest rates in December. The FOMC forecasts for 2016 are likely to be changed somewhat to reflect the data that have been released since June. But beyond these basic changes, we do not expect major changes to the FOMC's economic forecasts. We expect many FOMC participants to lower their forecasts for interest rates. A number of FOMC participants have said that they now expect interest rates to stay lower for longer. In effect, they have lowered their expected path for the "neutral" interest rate.

NAB: No Change Expected But Two Dissenters Likely.

The US FOMC announces their rate decision Wednesday along with the Fed Chair's press conference and the FOMC's latest forecasts of growth and inflation. Given recent speeches by Fed officials, we wouldn't be surprised to see two dissenters in a no change decision - those being George and Mester with Rosengren also a possible dissenter. Despite the likelihood of dissenters, the majority of the FOMC remain cautious in changing rates and the recent soft data flow will likely reinforce that approach. Aside from the decision itself, the focus will be on the Fed's latest forecasts for growth, inflation and the Fed Funds rate in their "dot plots" as well as Fed Chair Yellen's post-FOMC press conference.