Highlights of the BOC’s Monetary Policy Report:

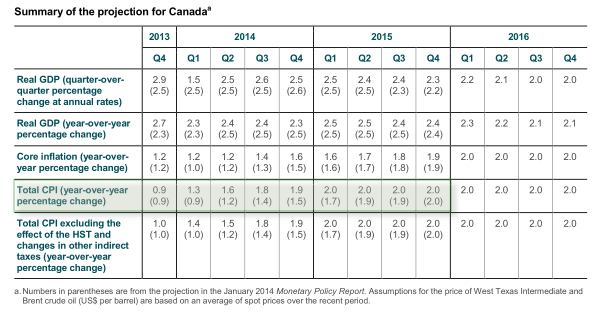

- Continues to see core inflation hitting target in Q1 2016

- Total CPI will be closer to 2% in coming months due to temporary upward pressure from energy, lower CAD

- Lower CAD over past year has put temporary upward pressure on inflation, offsetting supply and competition

- Sees 2014 growth at 2.3% vs 2.5% prior (consensus is 2.3%)

- Keeps 2015 growth projection at 2.5%

- Says 2014 total inflation higher than forecast

- Total CPI 1.6% in Q2 vs 1.2% prior

- Core CPI in Q2 1.2%, unchanged

- Exports to pick up but profile lower than in Jan, business investment also lower

- Sees soft landing in housing

- Lower CAD should support exports

- US 2014 forecast 2.8% vs 3.0% prior

- Europe forecast 1.1% vs 0.9% prior

- Global forecast 3.3% vs 3.4% prior

- Full text of the MPR

Bringing forward that inflation forecast is the big change. That’s hawkish. The knee jerk in USD/CAD is higher but I don’t see it. Inflation forecasts are significantly higher and that should squash any talk of rate cuts.