Bank of Japan (BOJ) Governor Kuroda speaking in parliament today

- Price trend expected to continue improving

- Japan inflation will steadily head towards 2% target

- Japan's economy improving gradually

- Pace of wage growth somewhat slow when considering very tight job market, record high corporate profits

- Have no plan, and no need, to change 2% inflation target

- Won't hesitate to adjust policy if needed

- No plan to ease policy now

- QQE policy has a risk for BOJ's finances

- Japan's potential growth rate is at or below 0.5%

-

Is Kuroda right to be confident?

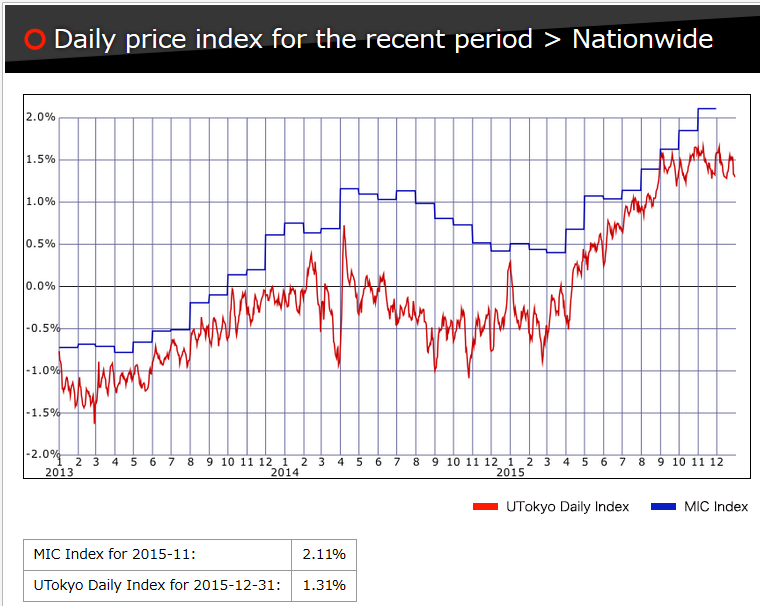

I haven't taken a look at the UTokyo inflation index for a while:

Looks to be flattening out?

Its recently had some changes made:

We are pleased to announce important changes regarding the UTokyo Daily Price Index from January 2016.

The number of stores from which prices are collected and the number of items covered will be substantially increased, and several new series, such as the frequency of temporary sales, will be added.

Along with this, the name of the index will change to "Nikkei CPINow," and it will be jointly provided by Nikkei Inc. and Nowcast Inc.

The latter is a new company started by Professor Tsutomu Watanabe of UTokyo with financial support from the University of Tokyo Edge Capital (UTEC) and Nikkei Inc.