CIBC thinks it can

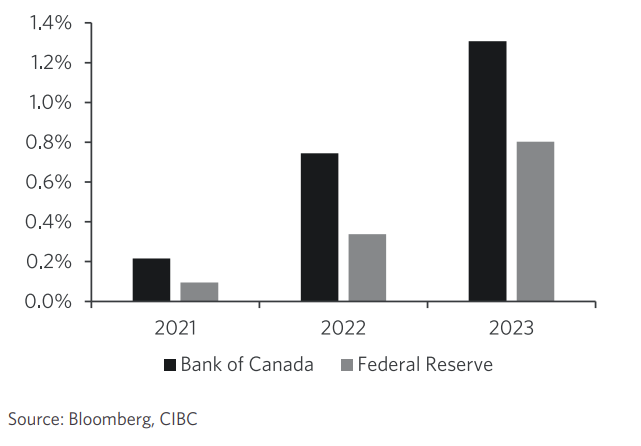

Here is what's priced in for the Bank of Canada and Federal Reserve in terms of rate hikes:

That's an earlier liftoff and faster pace of hikes from the Bank of Canada. Much of that makes sense given that the BOC has already begun to taper and has laid out a path to rate hikes. Meanwhile, even the Fed's more-aggressive dots point to a much slower pace than the BOC.

So if you take everything at face value, then the market pricing makes sense. However, central banks are terrible forecasters of rate hikes and markets aren't much better.

CIBC is instead looking at inflation dynamics in both countries and thinks the Fed could hike first.

Overall, we expect US CPI inflation to average 3.8% and 2.9% in 2021 and 2022, respectively, well above our projections for inflation of 2.8% and 2.2% over the same years in Canada. Still, as illustrated in Chart 8, the market is pricing in a notably more aggressive response by the Bank of Canada relative to the Fed. We think the market is wrong on this one.

They believe that Canadian households can't withstand rate hikes as well as the US because of a large buildup in debt since the financial crisis. They estimate a 100 bps hike would trim disposable income by 1.8% in Canada versus 0.9% in the US.