Deutsche Bank in NY is out with a detailed piece of research titled "Market liquidity and Fed liftoff"

In summary, their main points are:

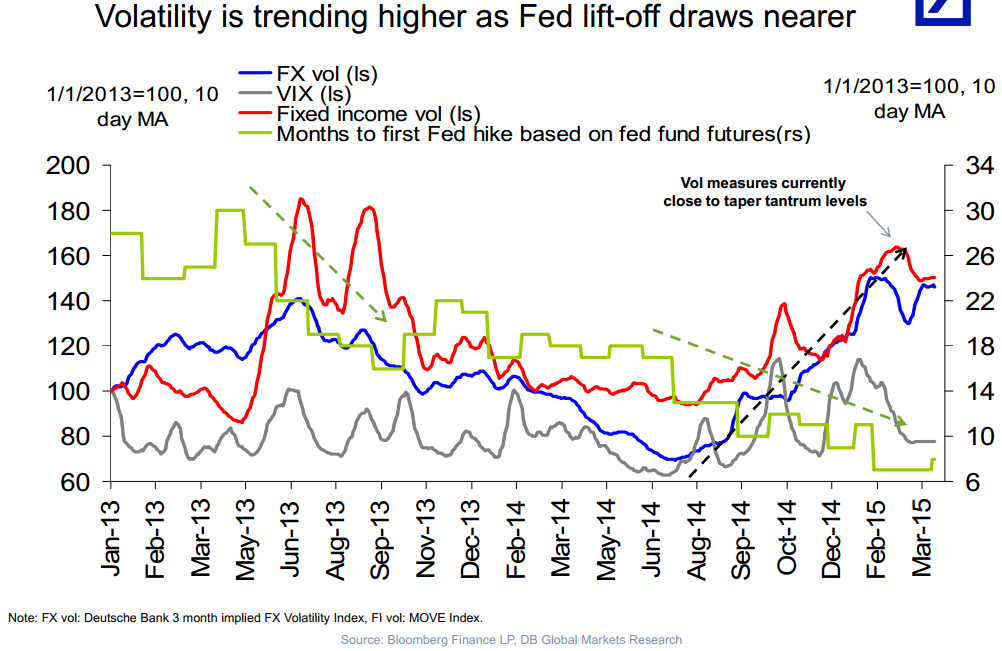

- Volatility has picked up as the markets prepare for Fed liftoff this year

- Concerns have risen that reduced liquidity in fixed income markets may amplify adverse reactions to the shift in Fed policy when it does occur or to other shocks

And .... their Bottom Line:

- While there is growing evidence of illiquidity in these markets,so far at least, this has not translated into broad market impairment

- But liquid markets could quickly turn illiquid in response to a shift in Fed policy or some other shock, which could amplify any adverse market response, as occurred during the taper tantrum

- We will continue to track these metrics on an ongoing basis to see how these conditions evolve Stay tuned

-

While the focus of the piece is the fixed income markets, FX should see swings as well (we already are!) I'd pick a bone with this: "in response to a shift in Fed policy or some other shock". Given how clearly the Fed is communicating that a hike is coming (sure, timing is in question ... again I'll repeat watch the data) a hike will not be a shock. But, maybe it will be to those not paying attention.