The ECB certainly has options tomorrow:

- Refi rate cut

- Bringing the deposit rate below zero

- Another LTRO, likely longer than 3 years

- ESM banking licence

- Something else powerful and mysterious

- Bond buys

- A combination of all of the above

Current expectations are built around Friday’s Bloomberg article:

Draghi’s proposal involves Europe’s rescue funds buying government bonds on the primary market, flanked by ECB purchases on the secondary market … Further ECB rate cuts and long-term loans to banks are also up for discussion, one of the officials said.

I want to focus on bond buying and why it won’t work.

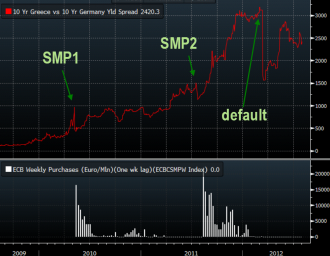

The ECB’s bond buying program (SMP) has been dormant for 20 weeks but was introduced in May 2010 to great fanfare.

The shock of the program sent Greek 10-year yields to 8% from 12% almost immediately but six weeks later they were back over 10% and were revisiting the highs within 5 months.

The euro jumped more than 300 pips but reversed all its gains within the day and declined for the next four days.

When the ECB introduced the SMP, it said the objective was “to address the malfunctioning of securities markets and restore an appropriate monetary policy transmission mechanism.”

If anything, the market was underpricing the risk of Greek default at the time.

In the end, the ECB bought up nearly one-quarter of the €206 billion debt outstanding, yet all it accomplished was provide an opportunity for bondholders to get out of the way.

The ECB currently holds €219.5B in government bonds via the SMB. According to guesstimates from Citigroup, because the official data isn’t released, the composition is about 45% Italian debt followed by Spain 19%, Greece 18% Portugal 10% and Ireland 8%.

The main result of the buying so far was to create a massive headache when Greek defaulted and the ECB refused to take a loss. This created a two-tiered structure where the ECB is senior to to senior bondholders, which perversely makes private investors less likely to buy periphery debt.

There is talk the ECB could abandon its seniority and write down some debt tomorrow as part of the solution but that raises legal problems.

At best, bond buys would give European leaders a few months to come up with a real solution but they have failed in the past and will fail again unless periphery countries can bring debt to sustainable levels.