A preview of the European Central Bank monetary policy meeting via Westpac

Increasingly, it is becoming evident that Euro Area growth is past its peak.

- The outlook for the ECB will depend heavily on the pace of slowing seen across the region. If inflation is to move towards trend, then above-trend growth must persist throughout the forecast period.

While not anticipating a collapse in growth by any means, we continue to believe that remaining slack in the Euro Area combined with a softening growth pace (from 1.25ppts above trend in 2017 to closer to 0.25ppts in 2019).

- To our mind, this will not be enough to drive inflation to target, but will see it move closer than it has been.

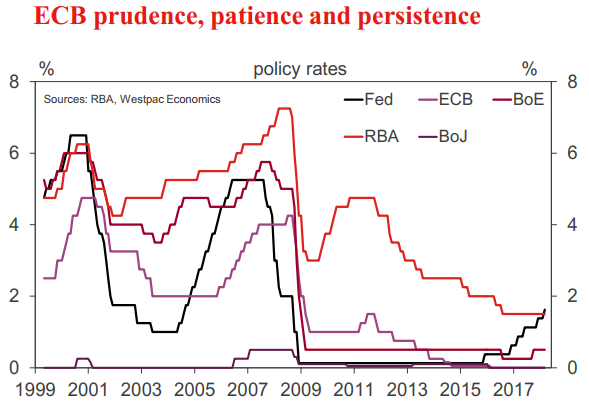

The consequence of the above outturn should be a slow end to asset purchases, extended to December, followed by an unwinding of negative interest rates in H1 2019, and an eventual rise in the refinance rate, in Q4 2019.

- In the near term, the tone of language will be all that changes.

--

I posted previews earlier here: An early preview of the ECB meeting this week

(Citi, Barclays, Morgan Stanley)