The Federal Open Market Committee meet this week, statement due on Wednesday May 1 2019.

Posted already:

- Federal Reserve FOMC meeting this week - heads up preview

- USD: Scope for FOMC to cut IOER on Wed - MUFG

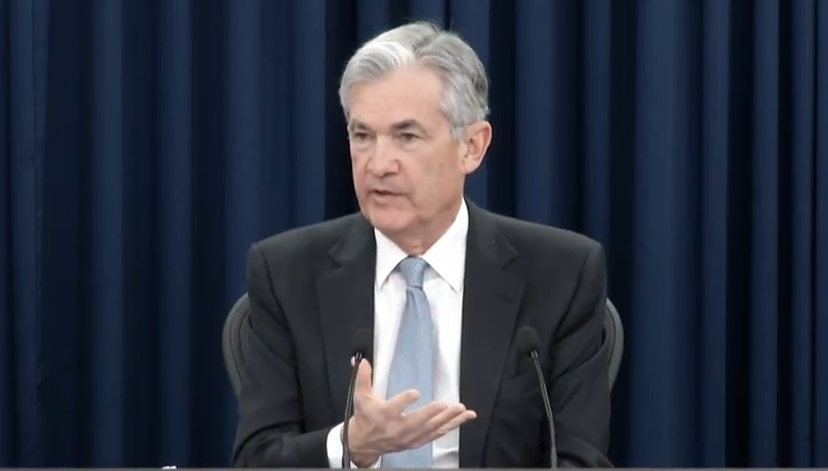

Comments on what to expect via TD, they say that with an unchanged decision expected to pay attention to Chair Powell's post-statement press conference.

we expect Powell to stay on message

- with a patient approach in order to continue to support the expansion

- These comments should be neutral for a market that is aggressively pricing in cuts for this year.

- That said, Powell has surprised in a more dovish direction at the last few meetings

biggest dovish risk for the statement would be if "patient" was replaced by language suggesting that "the Committee stands ready to adjust policy as necessary" to support the expansion.

- We see a modestly low probability of this change, but we cannot rule it out.

- Similarly, while we expect Powell's comments will keep open the possibility of rate cuts later this year, it would be both notably dovish and unexpected if he suggests the FOMC is actively considering scenarios in which the Fed cuts rates.

Powell is likely to give a mixed message with regard to the outlook:

- several of the downside risks that concerned the FOMC earlier in the year - including Chinese growth, Brexit, and tighter financial conditions - have since faded or been postponed

- although other sources of uncertainty - such as European growth and trade policy - still linger.

While rates will remain on hold through next year in our view, markets will be keenly focused on any hints that the Fed may be contemplating rate cuts this year.

- We expect Powell to be very noncommittal in his press conference answers, suggesting the Fed has no policy lean or bias and stands ready to adjust its tools as needed.