Scanning through some of the analysis on the June 2018 Federal Open Market Committee decision and Powell's press conference

This summary via ANZ:

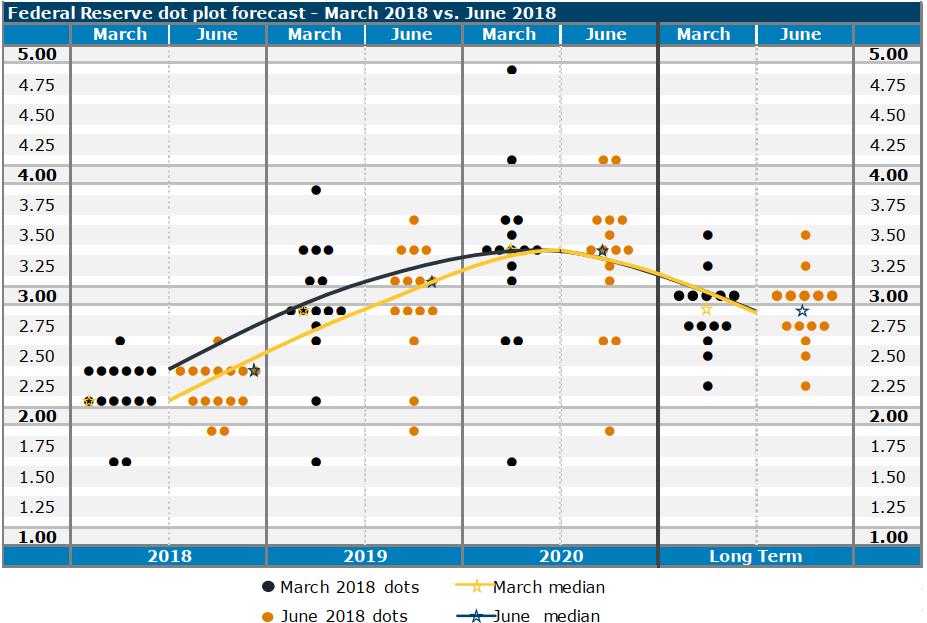

- The Fed raised rates 25 bps, indicated two more hikes this year and three more in 2019. The revised interest rate profile comes amid a solid growth outlook and greater confidence that inflation is converging on target.

- The Fed's projections imply a sustainable attainment of the Fed's dual mandate of full employment and 2.0% inflation. The longer run projections were unchanged with trend growth estimated at 1.8%, unemployment at 4.5% and inflation at 2.0%.

- Fed Chairman Powell confirmed that the Fed will hold a press conference after every FOMC meeting starting in January 2019. The Fed also cut the length of its statement and reduced forward guidance. The Summary of Economic Projections will continue to be published quarterly.

- In another change, the IOER will now be set 5 bps below the upper limit of the fed funds target range, in a purely technical move. Today the IOER was increased 20bps