Economists from Goldman Sachs examines whether Federal Reserve Chairman Janet Yellen will lift rates on Thursday

Goldman Sachs says the Fed decision on September 17 is a relatively easy call -- there will be no rate hike.

We adopted a December liftoff forecast following the June FOMC meeting, largely because this seemed to be Chair Yellen's own baseline. Recent events have further strengthened our conviction that next week is too early for a rate hike.

Economic data has been solid but not impressive enough to risk turmoil. Inflation numbers have been particularly mediocre.

Even if we focus only on the economic data, it is hard to argue that developments have beaten expectations on net. Although the growth data have been quite good and the labor market has improved further, both wage and price inflation have fallen short of expectations.

What Goldman economists and others have pointed out is that the market has tightened without the Fed's help because of increased volatility.

Once we broaden the perspective to include financial conditions, developments have been worse than almost anyone expected. ... This has led us to shave our growth forecasts over the next three quarters by ¼ point, with risks that still tilt to the downside.

Fed officials have made it clear that "data dependent" policy refers not only to data releases but also to factors that could impinge on the outlook, including changes in financial conditions.

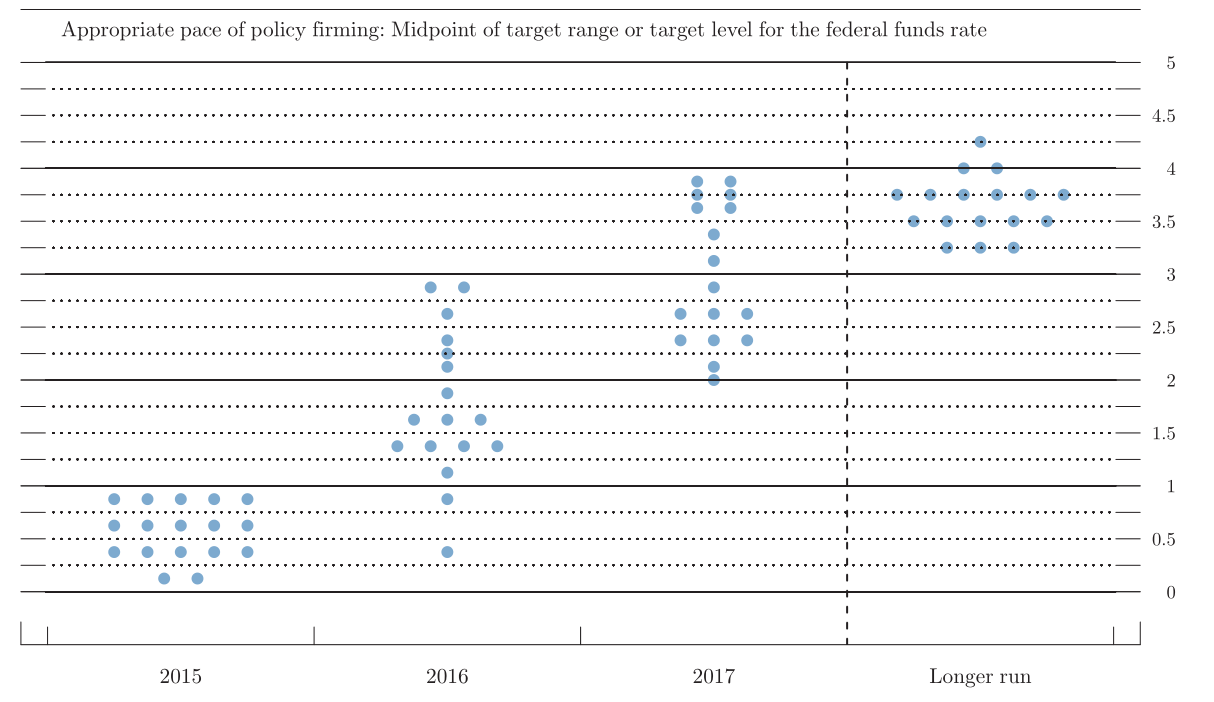

The important thing to watch on Thursday will be the message that officials send out about future tightening and the timing of liftoff. In particular, they will monitory the Fed forecasts and the 'dot plot'.

Expect virtually all the 2015 dots to fall down to the first or second line.

We expect the message from the committee as a whole-including the "dot plot" and the post-meeting statement-to signal a December liftoff.

However, we will listen closely for any hints in Chair Yellen's press conference that she is now leaning toward a 2016 liftoff. Although most standard Taylor rules suggest that rates should rise soon, we find the arguments for a further delay-the asymmetric risk of moving too early vs. too late and the recent tightening of financial conditions-quite compelling and think they may resonate with her as well.