Earlier this week the IMF forecast a 1-in-3 chance of the eurozone sliding back into recession but it’s higher than that.

They didn’t factor in the latest economic data and projections and the gloom that’s creeping into markets.

This week’s data from Germany:

- German factory orders -5.7% vs -2.5% exp

- Industrial production -4.0% vs -1.5% exp

- Exports -5.8% vs -4.0% exp

Given that weakness and the new-found weakness in European stocks, that probability has probably risen above 50% already. Whatever German 10-year bunds at 0.88% are signaling, it’s not good.

The German GDP forecast from the German institute fell to 1.3% from 1.9% this year and today Reuters reports the government will cut to 1.25%. Meanwhile, France is expected to grow just 0.4% and Italy is likely to contract 0.2%.

There’s plenty of talk about the US economy and the Fed this week but the real story is Europe. All these growth estimates might prove to be overly optimistic.

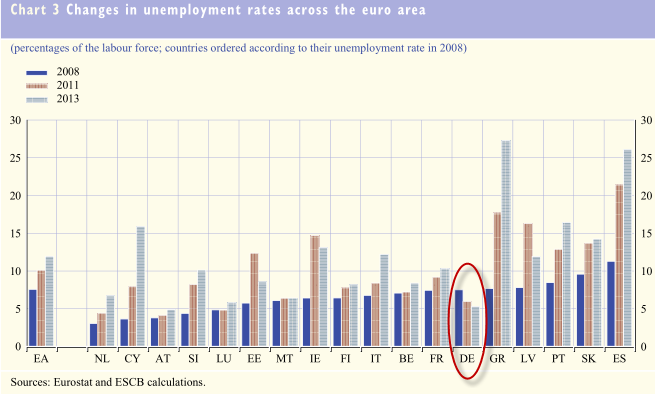

There’s a lot of focus on Germany here but that’s because it’s the biggest economy and the only country that’s made any progress in the past 6 years.

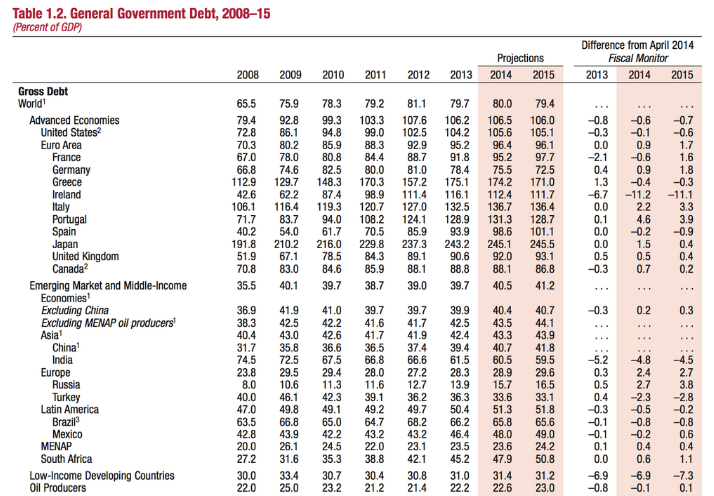

What’s even scarier is that no one has any news ideas and governments have no money to spend. Government finances have taken an absolute beating and the size of the eurozone economy is still well-below 2007 levels.

IMF debt projections

What makes anyone believe governments will suddenly spring to action and reform now when they couldn’t at the height of the crisis two years ago.

It’s fitting that Germany is finally starting to feel the pain in the rest of the eurozone.

Germany led the disastrous austerity charge that has only crippled the recovery when it should be taken hold. Rather than focusing on spending cuts, laws to enhance productivity and infrastructure spending would have been a better solution. But even with all that, the economy might be in much better shape if the Bundesbank would have taken the reigns off the ECB.

It’s almost comical that now — 6 years after the crisis — the ECB is finally running a comprehensive asset quality review at banks. That’s not just an ECB issue, it underscores the impossibly slow-moving bureaucracy of the eurozone.

For the first half of this year the ECB was steadfastly, almost laughably, sticking to its growth and inflation forecasts. They finally took steps in May and then made a dramatic, panicky move in September.

The irony here too is that the clownish, single-minded technocrats at the Bundesbank have fought Draghi every step of the way. Worse yet, they continue to do so. Bundesbank President Jens Weidmann was in the WSJ earlier this week taking a shot at the ECB.

While France and Italy, struggling with stagnant economies, have recently argued for more leeway in applying the European Union’s budget rules, Mr. Weidmann—one of Germany’s leading public figures—signaled no flexibility. The IMF and other international institutions have called on the ECB to consider buying government bonds, but Mr. Weidmann said such a policy would be a “dangerous path.”

The ECB’s Nowotny earlier this week said sovereign QE is still at “the discussion stage” and the first round of the TLTRO was a near-disaster.

So here’s the bottom line:

Europe is headed toward mild growth at best and is 50/50 towards a recession. Governments are totally inept and the ECB is out of ideas. What’s to like?