A surprise decision from the Reserve Bank of New Zealand on Wednesday:

- RBNZ policy announcement - says level of stimulus to be reduced

- RBNZ policy decision minutes: 'least regrets' decision is reducing some support sooner

- NZD/USD higher after the RBNZ tilts more hawkish than was expected

Rate hike expectations shifted forward in response:

- New Zealand bank ASB now forecasting an August RBNZ cash rate hike

- ANZ shift its forecast for the RBNZ to an August rate hike

ICYMI, BNZ have also moved their cash rate hike forecast to the August meeting.

Given today's signals from the RBNZ we formally shift to an August start in the process (from November previously). That's not to say a hike next month is a done deal. However, August sits more comfortably with us given;

(In brief) BNZ then cite:

- our core view that the Bank should (rather than would) already be in the process of exiting its emergency setting on the OCR.

- our expectation that Friday's Q2 CPI will highlight ... core inflation more surely running consistent with the Bank's inflation mandate

- our belief that the June quarter labour market data will prove stronger than the May Monetary Policy Statement (MPS) figured on

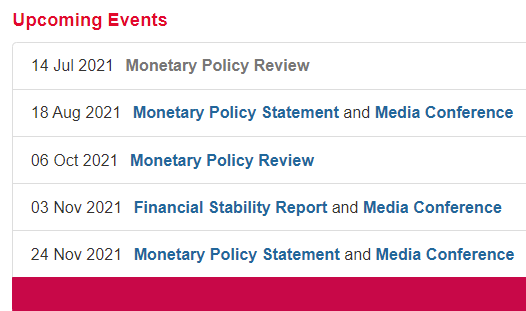

August 18 is very much 'live':