Reserve Bank of Australia monetary policy decision for April 2019, along with Governor Lowe's Statement

The RBA maintains its comfortable outlook, and have gained in confidence if this is anything to go by (bolding mine … and underlined the really important bit):

- The Australian labour market remains strong. There has been a significant increase in employment and the unemployment rate is at 4.9 per cent. The vacancy rate remains high and there are reports of skills shortages in some areas. The stronger labour market has led to some pick-up in wages growth, which is a welcome development. Continued improvement in the labour market is expected to see some further lift in wages growth over time, although this is still expected to be a gradual process.

Otherwise its a familiar sort of refrain from the Governor:

outlook for the global economy remains reasonable

- growth has slowed

- and downside risks have increased

- Growth in international trade has declined

- investment intentions have softened in a number of countries

- In China, the authorities have taken steps to ease financing conditions

Global financial conditions remain accommodative and have eased recently

- risk premiums remain low

- Equity markets have also risen and are being supported by growth in corporate earnings

- In Australia, long-term bond yields have fallen to historically low levels and short-term bank funding costs have moderated further

- The Australian dollar has remained within its narrow range of recent times

The Australian labour market .. (See above for this)

GDP data paint a softer picture of the economy than do the labour market data

- Growth in household consumption is being affected by the protracted period of weakness in real household disposable income and the adjustment in housing markets

- drought in parts of the country has also affected farm output

Offsetting these factors, higher levels of spending on public infrastructure and an upswing in private investment are supporting the growth outlook, as is the steady growth in employment.

adjustment in established housing markets is continuing

- Credit conditions for some borrowers have tightened a little further

- demand for credit by investors in the housing market has slowed noticeably

Inflation remains low and stable

… On inflation the statement lowers RBA expectations a touch.

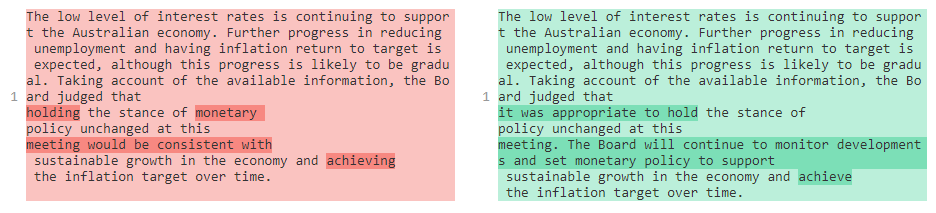

The 'key' final paragraph changes (March on left in red, April in green on right):

(ps. full comparison f the statements on the following post)

Full text: