The Reserve Bank of Australia statement follows a busy week for the Bank; Tuesday was the first meeting of 2018 and on Wednesday Governor Lowe spoke

- The quarterly Statement on Monetary Policy (SOMP) is due at 0030 GMT

Preview, this via ANZ (in brief and comments on AUD bolded bt me):

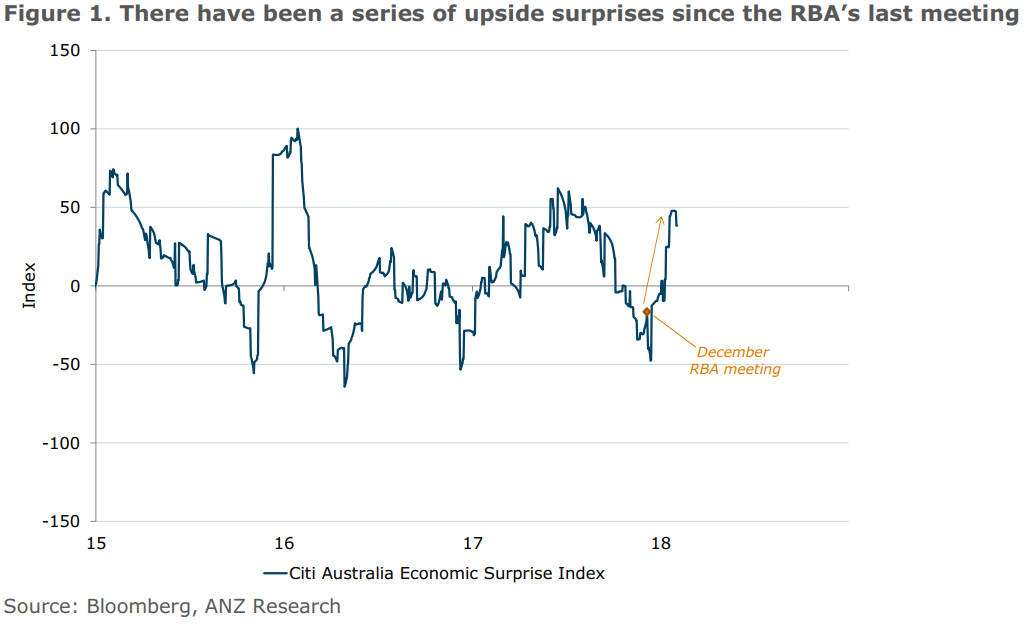

We expect a relatively upbeat tone to the growth outlook in Friday's Statement on Monetary Policy (SoMP), given a backdrop of a global synchronised upswing and strengthening domestic data

- The Bank is likely, however, to continue to acknowledge that there is still a substantial amount of spare capacity in the labour market and that wages and inflation are expected to rise only very gradually.

- The broad themes are likely to be little changed since the November statement, although the Bank is very likely to have more confidence in the outlook and to view the downside risks as having lessened.

outlook for non-mining business investment has strengthened further since the November statement

- Moreover, given the sharp upswing in consumer confidence and the improvement in retail sales the downside risks to consumer spending look to have lessened.

- Employment has continued to surprise on the high side

- Underlying inflation for Q4 looks to have been in line with the RBA's November forecasts

While the RBA may be more confident about the outlook, we expect that it will leave its GDP forecasts largely unchanged - although the risks are tilted towards a small upgrade.

- Its language around the outlook though is likely to have a more upbeat tone ... the discussion of risks is likely to be more balanced

RBA may nudge its unemployment rate forecasts a little lower.

- We think it is likely that the Bank will reduce its 2018 year-end forecast from 5½% to 5¼%. With the extension of the timeline out to mid-Jun 2020, we expect the RBA to predict 5% by the end of the forecast period.

On the inflation front, we expect no change to the forecasts

- There has been little change around the inflation dynamics over the past quarter, in our view

In terms of the exchange rate, we expect little change to the RBA's commentary.

- While the AUD is up around 5% against the USD since the last SoMP, on a trade weighted basis the exchange rate is up just under 1%. This seems fairly unremarkable from the perspective of the growth and inflation outlook given it has been accompanied by a sharp rise in commodity prices.

- There is a chance, however, that the RBA expands a little on its comments about the risks posed by a higher AUD in order to offset the potential market reaction to a more upbeat tone.

We will be watching for any change of the Bank's wording on financial stability... any material change will be of interest.