Speaking in Geneva

She adds:

- Bank policy remains based on negative interest rate and currency market interventions

- Swiss franc remains highly valued despite recent weakening

- Believes interest rate differential between Switzerland and other countries may widen in future

- Assumes global economic outlook will firm

Also commenting is SNB's Dewet Moser:

- Currently there is no acute appreciation pressure on Swiss franc

- Recent Swiss franc weakening remains fragile, cannot rule out renewed large-scale rise in future

The EURCHF is trading near it's highest level since that fateful day in January 2015 when the SNB pulled the plug on intervening against the 1.2000 level. It trades at 1.1686. The high in 2017 (and high since 2015) is 1.1708.

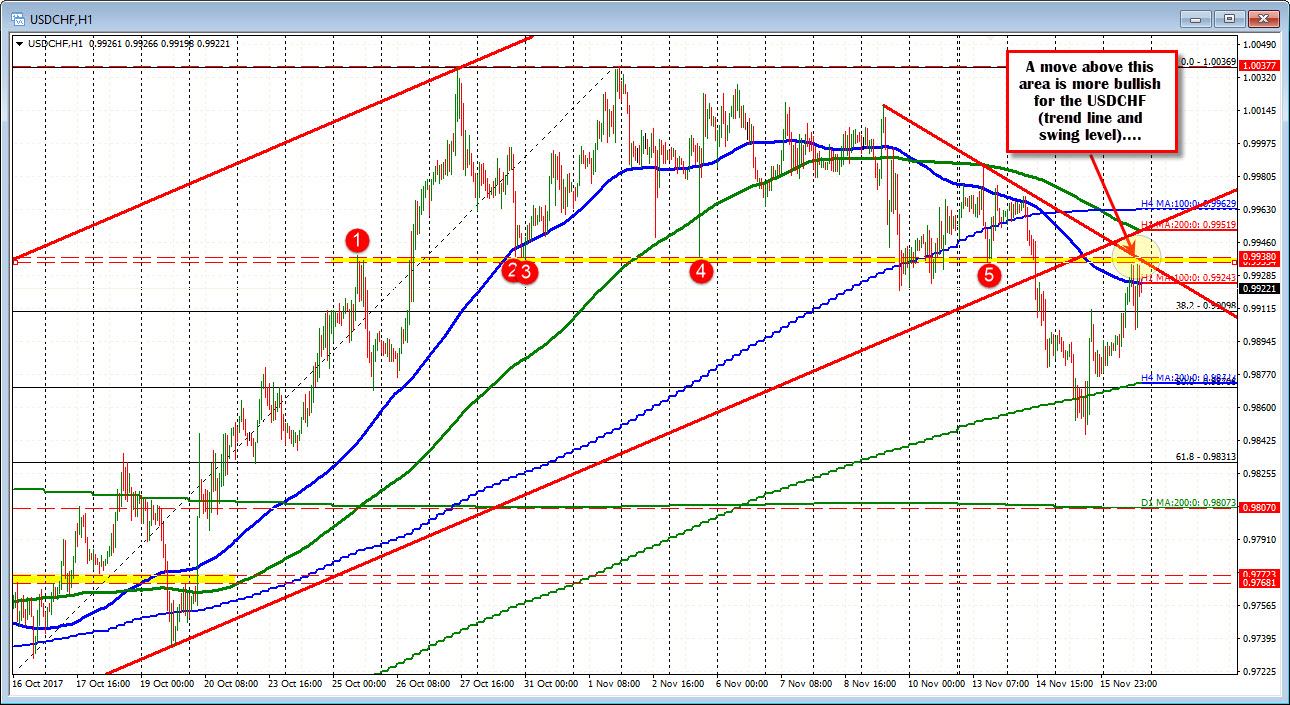

Looking at the USDCHF on the hourly chart, the pair has been trading above and below its 100 hour MA for most of the NY session at 0.99243 (blue line in the chart below). We currently trade right at that level, looking for the next push. A move above the 0.9935-38 (trend line and swing levels) would be more bullish for the pair.