The Fed may want to re-establish some believability next week

When the Federal Reserve says it will hike twice this year the market shrugs.

What's priced in for the Fed is just a 17% chance of a hike in June and a 60% chance of a single hike by year-end.

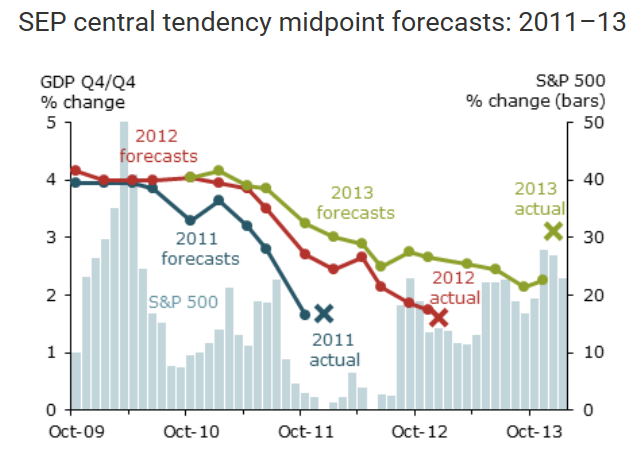

Years ago, if the leader of the US central bank said he was going to hike, the market took it as near-gospel. But since the crisis Fed forecasting has constantly, repeatedly and consistently over-estimated growth and inflation.

At the start of every year, the Fed forecasts +3% growth for the year ahead only to constantly revise down expectations as the economy struggles to grow 2%.

This chart shows the progression and even 2013 GDP was eventually revised to just 1.5%.

The good news may be that the Fed has finally adjusted. Their forecast for this year is just 2.2% growth, although Q1 may be close to flat when the first estimate is released next week.

What next

Enough background, what does it mean going forward? The Federal Reserve should be alarmed but how easily the market dismisses its economic forecasts but it should be down right frightened by its lack of credibility on rates.

Earlier this month, when Chicago Fed President Charles Evans said two hikes this year are "appropriate". He later even mulled the possibility of three hikes and the market still didn't blink. Evans is the most dovish FOMC member so he is the least likely to support a hike and yet he's out there saying rates will rise and no one listens.

The Fed is in a position to regain forecast credibility. Stock markets are in much better shape, economic data has been fine and worldwide growth is decent. Most importantly, commodity inflation is now in the pipeline.

Watch the April 27 April FOMC for hints. In the days ahead I'll be looking more closely at the credibility problem and the ways to trade it.