The Cult of Carney is bizarre. His track record is dismal.

Mark Carney has been a top global central bank for a decade and I struggle to think of a single instance where I can say, "Mark Carney got that right." He has never been ahead of the curve.

Today he said that the 15 minutes of fame of central bankers is almost over because fiscal, structural and trade policy will take the burden. It's a hint this is the end of the era of ZIRP, QE and experimental monetary policy.

That's rich from a central bank who scaremongered before the Brexit vote, saying it was the biggest risk facing the UK economy and warned it could cause a recession.

Today he squared his newfound optimism by patting himself on the back and saying that a single BOE rate cut in August has helped save the nation. There is a case to make that what BoE did last Summer supported the economy and will continue to help as incomes get squeezed, he said after the BOE decision.

Even if you can forgive his Brexit missteps, his overall record as a forecaster has been poor. His 2014 Mansion House speech was just one time he thought he could outsmart the market.

"There's already great speculation about the exact timing of the first rate hike and this decision is becoming more balanced," he said. "It could happen sooner than markets currently expect."

The markets were right, he was wrong but his comment sent the pound to the highest it's been since 2008. A month later he doubled down and said the BOE didn't need to wait for wage to rise to hike.

"People might have different views on the exact timing, but it will happen and people should plan accordingly," he said.

It hasn't happened yet and there is still only a 50/50 chance it happens before he exits in 2019, especially if he gets jittery about a 3% rebound in the pound.

A year later at the 2015 Mansion House speech, he made the same blunder.

"The point at which interest rates may begin to rise is moving closer," he said, again triggering in GBP rise.

If Carney had stayed silent and let markets do their thing, or that if he had correctly forecast that the economy was struggling and was dovish, then the ensuing stimulus and lower pound would have helped the economy. You can even make the argument it would have helped the economy enough to reverse the result of the referendum.

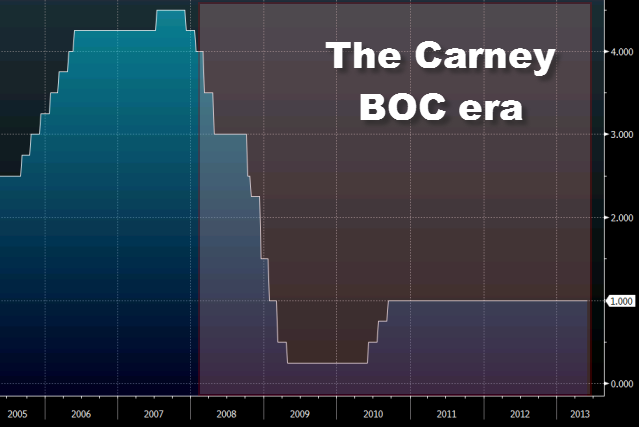

Same story in Canada

These weren't isolated events, Carney has consistently been wrong. In September 2008, two weeks before the collapse of Lehman Brothers he was oblivious.

"The three global developments highlighted in the July Monetary Policy Report Update continue to have a major influence on the Canadian economy. Two of them - the course of the U.S. economy and the ongoing turbulence in global financial markets - have evolved broadly in line with the Bank's expectations," the BOC statement said.

Even after the collapse, he remained largely blasé to what was unfolding and the profound repercussions.

Carney cautioned that while international events will have an important influence on our economy, "they must be considered in tandem with domestic factors, including the strength of domestic demand, the evolution of potential growth and the health of our financial system."

Overall, you have to give Mark Carney credit for being a survivor but beneath the unwavering self-confidence and calming delivery, there's nothing there.