I've posted up a few previews of the European Central Bank meeting this week

- Barclays expect President Draghi to announce a nine-month extension of the APP at a lower pace of EUR30bn per month

- Morgan Stanley outlook for the ECB meeting this week and BoE next

- UBS on what to expect from the ECB this week

On the EUR:

It seems expectations are high (and probably justified) for an ECB 'taper' announcement.

Draghi is likely to couch the announcement in the most dovish of dovey dovishness terms as is possible.

- Meanwhile, political tensions in Catalonia continue to simmer - if there is no Catalan capitulation the situation will get much worse before it gets better.

- I'd also mention the 'autonomy' votes in Italy (Italy voting - Lombardy voter 95% in favour or more autonomy) ... but I reckon they are a furphy (but even so, they may be enough to see more nervousness)

For the USD side ... positive headlines on the potential for a tax deal (cooler heads will point out that any deal is still a long way and much convoluted negotiation away ... but check out the USD response since the hints last Friday)

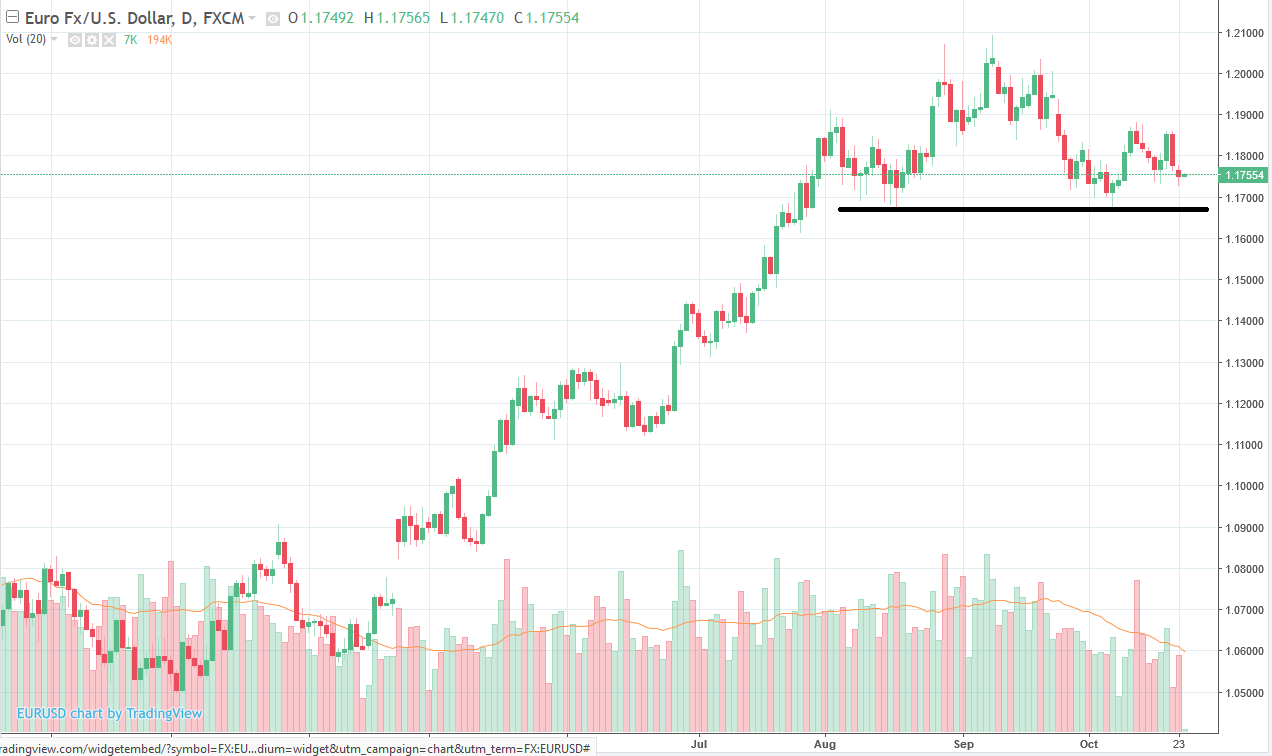

So ... lower EUR/USD? The chart is a wee bit precarious and indicates where we can expect some stop loss clustering (under the crudely drawn line):

Does that all add up to the potential for a push lower on or around the ECB meeting? Comments welcome!