BNP Paribas on how to trade after the Fed

The Fed has delivered its long-awaited 25bp rate hike, and as expected the accompanying statement and press conference signalled that further tightening would likely happen only at a gradual, and not necessarily even, pace, notes BNP Paribas.

The USD has struggled post-FOMC but BNPP thinks Fed developments should support the currency:

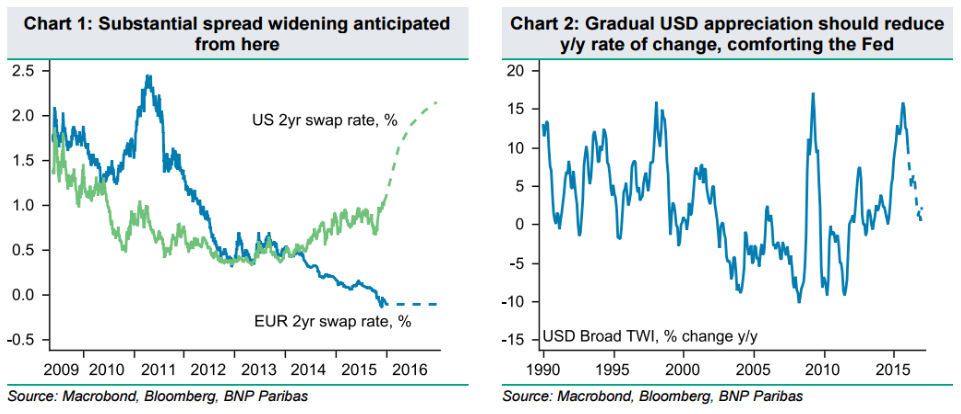

"However, the median projection for the Fed funds rate at the end of 2016 remained unchanged at 1.4%, more than 50bp above what rate futures were implying heading into the meeting. While the USD struggled in the immediate aftermath of the news, it has now begun to gain ground broadly and we believe the Fed result is likely to be significantly supportive for the dollar in the weeks ahead. This is especially the case given the pullback in the USD in the first half of December and the shakeout in long USD positions ahead of the FOMC. As Chart 1 shows, even a cautious path of Fed rate hikes over the coming year implies significant further widening in front-end yield spreads in the USD's favour," BNPP notes.

Fed focus on FX creates a headwind for USD momentum but y/y change in the USD should ease:

"The Fed's focus on exchange rate risks remains a headwind for USD momentum, with USD bulls likely to remain wary that very rapid USD gains could curtail rate hikes. We think this dynamic will ensure that USD gains are gradual. Notably, the pace of USD appreciation we anticipate should lead to a decline in the y/y pace of USD gains as we move through 2016, which should reduce Fed FX concerns somewhat. Sill, our economists expect that tightening financial conditions as EURUSD approaches parity in Q3 2016 are likely to drive a pause in the rate hike cycle ahead of the year end," BNPP projects.

Risk environment important for dynamics of USD gains:

"The nature of USD gains in the immediate future will depend on the risk environment. A key risk to our bullish USD view relative to the EUR, CHF and JPY would be a significant retreat in US equity prices as US front-end yields push higher, as these surplus economy funding currencies could benefit from a contraction in risk appetite. However, equity markets have so far responded positively to the Fed's decision on net," BNPP adds.

For trade ideas from banks, check out eFX Plus.