ANZ analysts say the weaker-than-expected inflation buys the RBNZ some time.

The data ICYMI:

ANZ, in brief:

- We now expect the RBNZ to hike the OCR 25bp in February, rather than November.

- Annual CPI inflation decelerated from 6.0% in Q2 to 5.6% y/y in Q3, weaker than our forecast of 6.1%, and below the RBNZ’s August MPS forecast of 6.0%. The downside surprise was on the tradables side.

- Non-tradables inflation came in at 6.3% y/y, slightly above the August MPS forecast of 6.2% y/y but below our forecast of 6.5%.

- While still far too high, core inflation measures improved, which will be pleasing for the RBNZ. CPI excluding food, fuel, and energy fell to 5.2% y/y (6.1% previously). Trimmed mean measures largely eased. At the 30% trim level, inflation eased from 6.0% y/y to 5.6% y/y. Weighted median inflation eased from 6.6% y/y to 5.0% y/y.

- Tradables inflation (largely imported) came in at 4.7% y/y (5.2% previously), well below our forecast of 5.5% y/y and the RBNZ’s forecast of 5.8% y/y. Petrol prices were higher, but not as high as we expected. Petrol price moves will be looked through, at least as long as inflation expectations continue to ease.

- The details of today’s data support our view that domestic-driven inflation pressures remain a significant problem. However, clear progress was evident, and that takes pressure off the RBNZ to move the OCR any time soon. In short, ‘hope for the best’ remains a valid strategy. Accordingly, we have pushed our forecast hike out to the next meeting, the February Monetary Policy Statement.

---

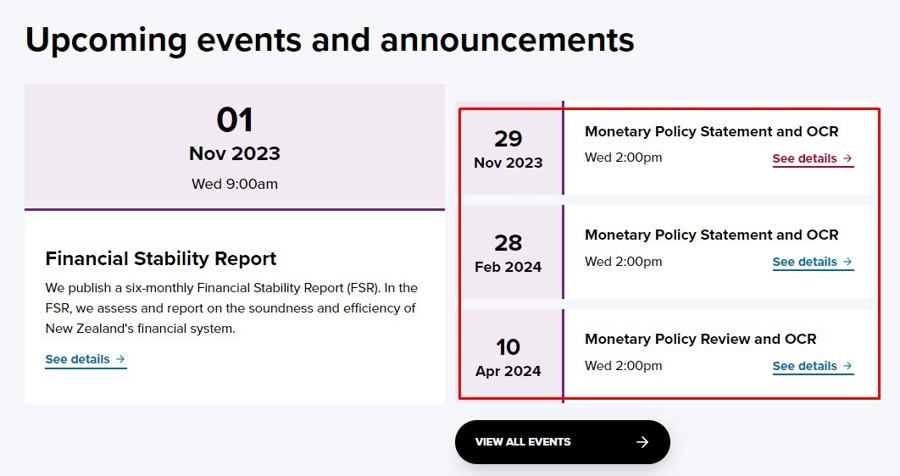

Upcoming Reserve Bank of New Zealand dates: