FOMC responses continue. This from Rick Rieder, a BlackRock Managing Director. Rieder is BlackRock's Chief Investment Officer of Global Fixed Income, Head of the Fundamental Fixed Income business, and Head of the Global Allocation Investment Team.

In brief:

- Today’s policy statement from the FOMC, and Chair Powell’s press conference, were signals to economic observers and to market participants that the job of inflation-fighting isn’t accomplished yet, but the trend is moving in the right direction.

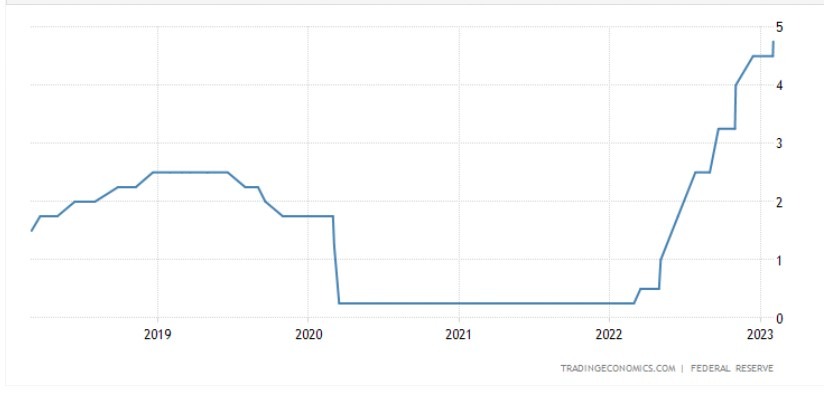

Consequently, the Federal Reserve can now move policy rates at a more normal pace ... 25 bps clip.

The Fed will now embark upon a process of slow and steady rate hikes of 25 bps moves, in order to better observe the incoming data and be able to react accordingly.

The direction of travel from here will be another 25-bps hike, and maybe one more after that.

Yet we’re very much now in the mode of slow and steady hiking toward an end state of resting at a restrictive interest rate policy level of around, or just above, 5%.

Graph source here