Bank of Japan Deputy Governor Uchida in Japan's Nikkei media this morning:

- Will maintain YCC from perspective of sustaining easy monetary conditions

- Want to make decision from perspective of how to sustain easy policy with eye on impact on financial intermediation, market function, when asked about likelihood of tweaking YCC

- Japan is seeing signs of change in corporate wage, price-setting behaviour

- Risk of missing chance to hit 2% inflation with premature policy shift is bigger than being too late in tightening monetary policy

- There is huge distance to ending negative rate, a decision that would be tantamount to a 0.1% rate hike

And, on the yen:

- Rapid, one-sided yen declines are undesirable, fx must move stably reflecting economic fundamentals

-

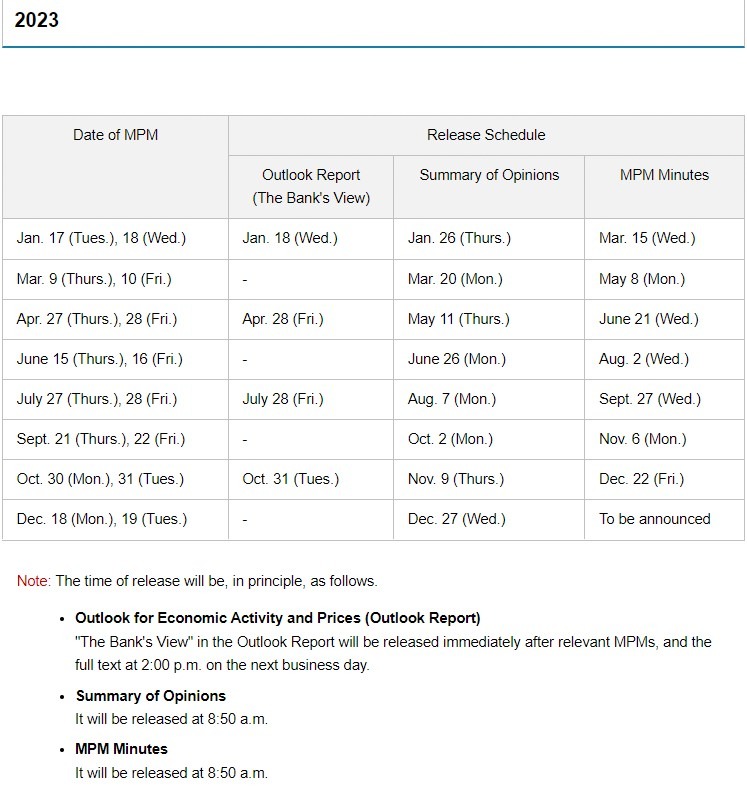

Uchida here is not indicating a near-term change to YCC, but he isn't sounding overly emphatic on it. Keeping alive the chance of a YCC tweak at the next BOJ meeting. There are a few weeks until the meeting and plenty more comments to come before then.