Via a Commonwealth Bank of Australia note on their Reserve Bank of Australia outlook.

This is the summary:

- Our assessment is that the 2023 Commonwealth Budget does not add to inflationary pressures in the economy.

- As such, we have not changed our forecast profile for inflation or our call on the RBA.

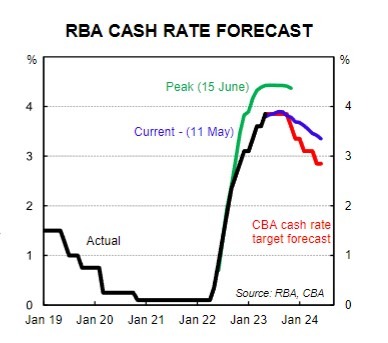

- Our central scenario puts the current 3.85% as the peak in the cash rate, while the near-term risk sits with another rate hike.

- Despite the 2023 Budget’s modest and targeted 'cost of living relief’, the budgets of many home borrowers and renters will be under considerable strain over the coming year.

- We continue to expect 50bp of rate cuts in Q4 23 and a further 75bp of easing in 2024 that would take the cash rate to 2.6% -a more neutral setting.

- The risk to the timing of the commencement of the easing cycle sits with the first cut arriving in Q1 24 rather than late 2023.

- The upcoming Fair Work Commission(FWC)decision on the national minimum wage will be critical to the outlook for wages growth and by extension inflation and the monetary policy outlook.

--

CBA graph:

ps. I think the above graph is of 3 scenarios CBA have for the RBA.

The middle projection is CBA base case. I could be wrong on this, I may have misinterpreted the graph.