This is via the folks at eFX.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.

- CIBC Research maintains a bullish bias on the JPY over the coming months, targeting USD/JPY at 125 by end of Q2, and 123 by end of Q3.

- "We anticipate the bank looking to ease yield curve distortions via the toleration of a wider fluctuation band for 10-year yields. An adjustment is likely to encourage domestic life companies to further materially increase domestic bond holdings, reducing foreign outflows and JPY selling accordingly. Having unexpectedly adjusted the YCC threshold in December, we would note that new BoJ deputy Governor Uchida underlined that any further YCC adjustments should not be communicated to the market prior to any adjustment," CIBC notes.

- "A YCC adjustment, tolerating higher 10-year JGB yields will alleviate a material kink in the Japanese curve, while concurrently making overseas bonds less attractive, even before more expensive hedging costs are included. Increasing levels of onshore investment, allied to the conclusion of Fed tightening in May, underscores the prospect for JPY gains," CIBC adds.

---

Take special note of what CIBC says there on Uchida:

- new BoJ deputy Governor Uchida underlined that any further YCC adjustments should not be communicated to the market prior to any adjustment

You'll recall the huge global market disruption when former Bank of Japan Governor Kuroda widened the JGB yield band at the December meeting. If the BOJ indeed insists on surprising again they are setting the markets up for further volatility.

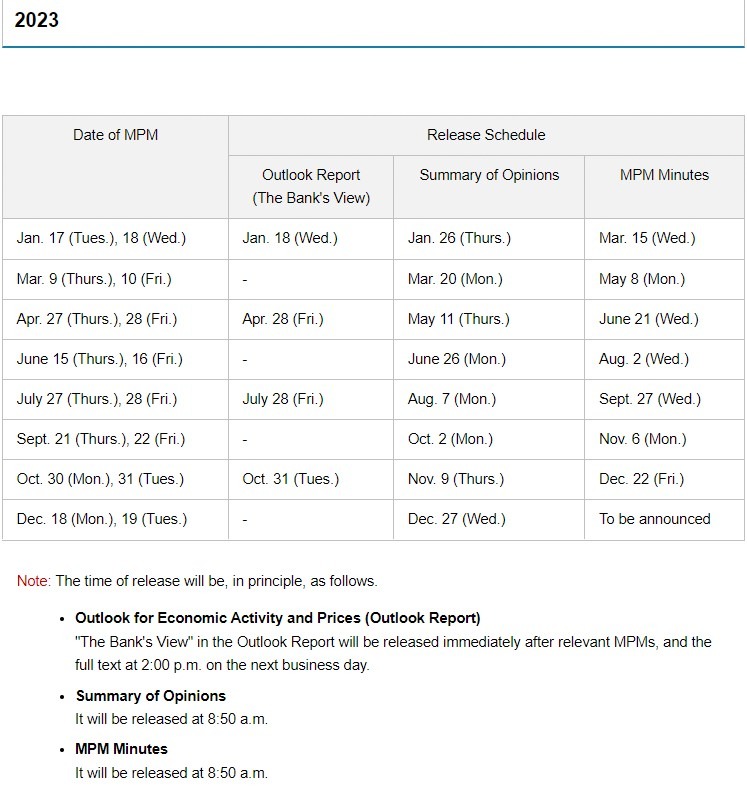

The next Bank of Japan meeting result will be on April 28.