- Dallas Fed manufacturing index for January -8.4 versus -20 last month (revised from -18.8)

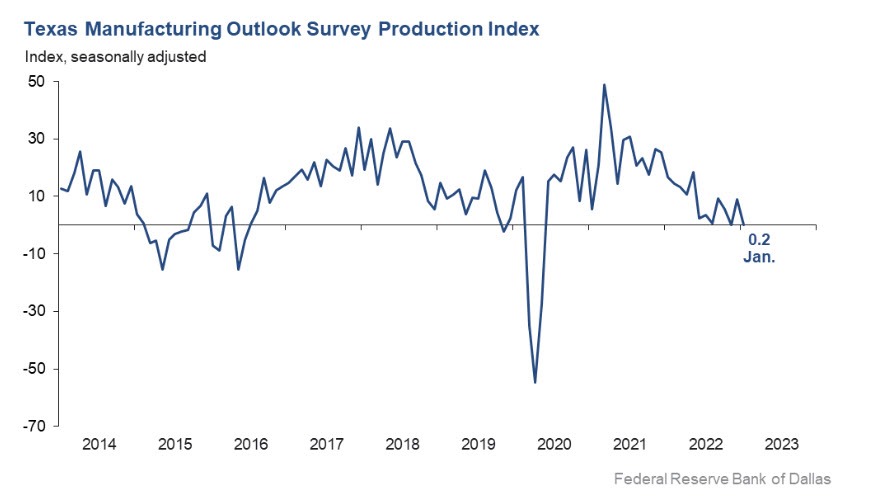

- Production index 0.2 in January versus 9.1 in December

- New orders index was negative for an eighth month in a row—suggesting a continued decrease in demand—though it moved up from -11.0 to -4.0.

- Growth rate of orders -12.3 versus -9.3 last month

- Employment 17.6 versus 13.6 last month

- Hours worked 3.8 versus 5.6 last month

- Capital expenditures 11.6 versus -2.5 last month

- Wages and benefits 30.5 versus 34.2 last month

- Prices received 9.9 versus 10.9 last month

- Prices paid for raw materials 20.5 versus 21.9 last month

- Finished goods inventory -8.9 versus -3.3 last month

- Shipments -6.3 versus +0.4 last month

Expectations regarding future manufacturing activity were mixed in January. The future production index pushed further positive to 16.1, signaling that respondents expect output growth over the next six months. The future general business activity index remained negative, coming in at -9.1. Most other measures of future manufacturing activity were positive this month.

The Dallas Fed conducts the Texas Manufacturing Outlook Survey monthly to obtain a timely assessment of the state’s factory activity. Firms are asked whether output, employment, orders, prices and other indicators increased, decreased or remained unchanged over the previous month.

Survey responses are used to calculate an index for each indicator. Each index is calculated by subtracting the percentage of respondents reporting a decrease from the percentage reporting an increase. When the share of firms reporting an increase exceeds the share reporting a decrease, the index will be greater than zero, suggesting the indicator has increased over the prior month. If the share of firms reporting a decrease exceeds the share reporting an increase, the index will be below zero, suggesting the indicator has decreased over the prior month. An index will be zero when the number of firms reporting an increase is equal to the number of firms reporting a decrease. Data have been seasonally adjusted as necessary.