Japanese authorities have expressed worries over the pace of yen falls. Over and over they have said rapid moves are undesirable.

- The TL;DR version is that they aren't overly concerned about the level of the yen, but rather the pace of its fall.

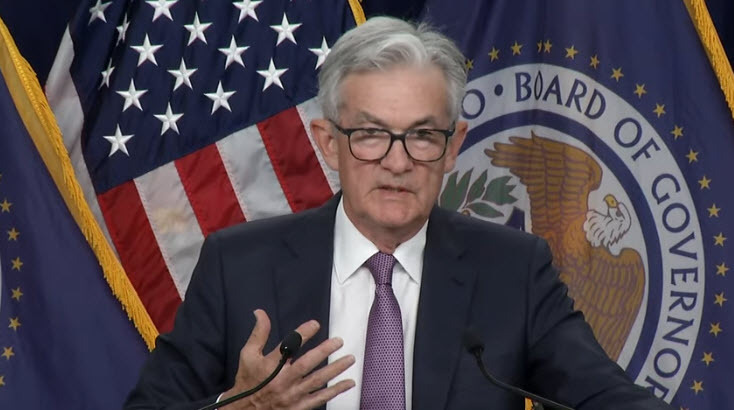

Similarly, from the Fed, this snippet via Bank of Montreal analysis of the Federal Open Market Committee (FOMC) on Wednesday:

- A core tenet of our view of the Fed’s willingness to continue pressing forward with additional tightening is that Powell is comfortable with lower equity valuations, and rather than the outright level of stocks, the more important factor is the rate at which they fall. An orderly selloff defined by another 10 to 15% decline in the S&P 500 over the course of several weeks and months is a far different situation than a similarly sized drawdown taking place in just a few sessions.

There is a lot more to the BoM note, the TL;DR version is that the FOMC is going to hike its way into recession. US and global. But, that's a topic for another post. The point of this post here is to point out the overconfidence and arrogance of these central bankers. Time and again their forecasts prove appalling bad, and yet here they are trying to manage the first derivative, the pace of moves.

The Reserve Bank of Australia was a prime example of this. Way back at the start of 2021 the RBA said it would not be hiking rates until 2024 at the earliest. I was scornful of this:

The RBA rate hike cycle began in May of 2022. To the extent borrowers heeded the 2024 prognostication of the RBA, Bank officials have a lot to answer for.

Be very wary of arrogant central bankers (and other officials).